Ram Ratna Wires Ltd (NSE: RAMRAT, BSE: 522281) has been on the radar of investors due to its steady financial performance and solid position in the winding wire manufacturing industry. In this blog, we will explore both the technical setup and the fundamental outlook of the company to help traders and investors understand its potential.

Company Overview

Ram Ratna Wires Ltd is the 2nd largest manufacturer of winding wires in South Asia and holds a significant market position in India. It is the only Indian manufacturer that offers a wide range of enameled copper wires, from ultra-thin wires of 18 microns (0.018mm) to 4.876 mm. This extensive product range gives the company a competitive edge in the industrial and electrical sectors, where winding wires are critical components.

Key Fundamentals

- Market Cap: ₹2,864 Cr.

- Current Price (as of Oct 1, 2024): ₹651

- 52-Week High / Low: ₹717 / ₹227

- Stock P/E: 50.5

- Dividend Yield: 0.38%

- ROCE: 17.4%

- ROE: 13.6%

- Promoter Holding: 73.04%

The company has demonstrated solid profit growth with a 25.6% CAGR over the last 5 years. Additionally, it has maintained a healthy dividend payout ratio of 29.2%, offering steady returns to shareholders.

Financial Performance

Revenue and Profitability

Over the years, Ram Ratna Wires has experienced continuous growth in both revenue and profits. Sales have increased from ₹747 Cr in FY2015 to ₹3,150 Cr (TTM), demonstrating a steady upward trajectory. Despite increasing expenses, the company has managed to maintain consistent Operating Profit Margins (OPM) of 4-5%, with Operating Profit of ₹130 Cr in FY2024.

Additionally, the company’s cash flows have seen improvements, with cash from operating activities reaching ₹138 Cr, reflecting a robust cash position. Borrowings have decreased over the years, which further strengthens its financial standing.

Key Pros

- Strong Profit Growth: The company has delivered a CAGR of 25.6% in profit over the last 5 years.

- Dividend Payout: A consistent dividend payout ratio of 29.2% shows the company’s commitment to rewarding shareholders.

- Market Leadership: Ram Ratna Wires holds a key position in the Indian and South Asian market, offering an unmatched range of wire products.

Peer Comparison

In comparison to its peers in the Non-Ferrous Metals Industry, Ram Ratna Wires stands out in terms of growth. While companies like Hindustan Zinc and Gravita India boast larger market capitalizations, Ram Ratna Wires has outperformed many in terms of profit growth and return on capital employed (ROCE).

| Company | Price (₹) | P/E Ratio | Market Cap (Cr.) | Dividend Yield (%) | ROCE (%) | Promoter Holding (%) |

|---|---|---|---|---|---|---|

| Ram Ratna Wires Ltd | 651 | 50.5 | 2,864 | 0.38 | 17.4 | 73.04 |

| Hindustan Zinc | 519.90 | 26.87 | 2,19,674 | 5.58 | 46.25 | 64.93 |

| Shivalik Bimetal | 649.35 | 48.45 | 3,740 | 0.26 | 33.66 | 51.14 |

| Gravita India | 2,464.90 | 66.88 | 17,017 | 0.21 | 27.86 | 63.37 |

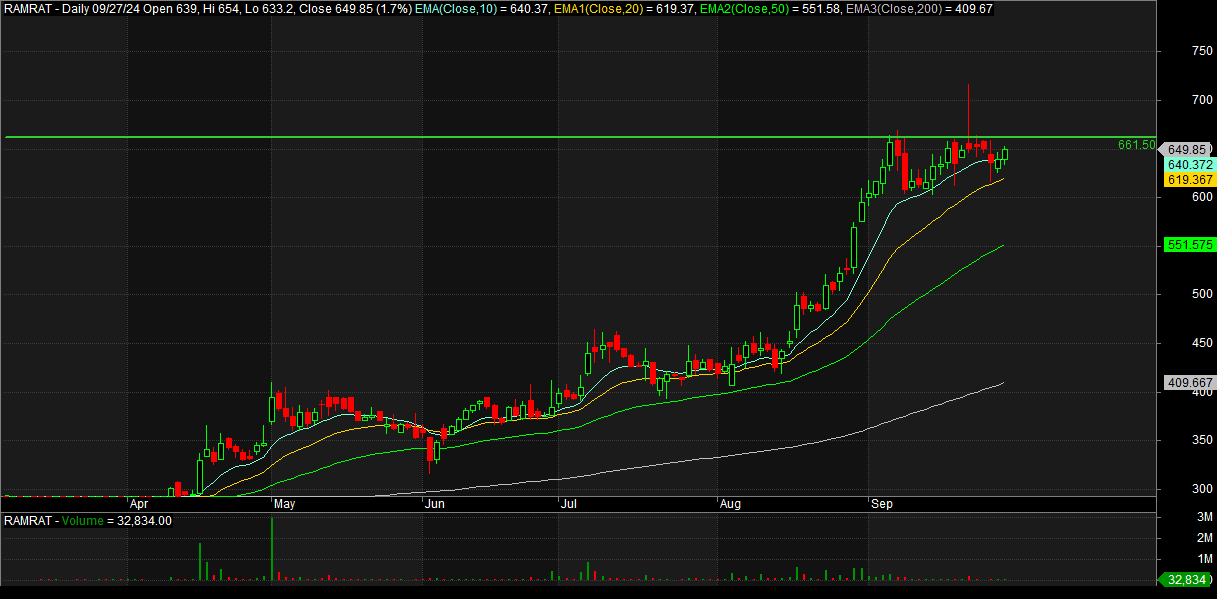

Technical Analysis: RAMRAT Stock Chart Breakdown

Ram Ratna Wires Ltd Daily Chart

Looking at the technical chart, Ram Ratna Wires Ltd has shown a strong upward momentum over the past few months. The stock closed at ₹649.85 on September 27, 2024, after touching a high of ₹654. Over the last six months, the stock has been on a consistent uptrend, forming higher highs and higher lows.

Support and Resistance Levels

- Resistance: ₹661.50 (Current 52-week high)

- Support: ₹620-650 (Strong support zone based on previous price action)

The stock has faced resistance at the ₹661.50 level, and a breakout above this point could propel it towards new highs. On the downside, there is strong support between ₹620 and ₹650, which could provide a buying opportunity for investors looking to enter at lower levels.

Moving Averages

- 50-day EMA: ₹551.58

- 200-day EMA: ₹409.67

The stock is currently trading well above its 50-day and 200-day exponential moving averages (EMAs), which indicates a bullish trend. The EMAs are also trending upward, which reinforces the positive sentiment around the stock.

Outlook for Traders and Investors

Ram Ratna Wires Ltd is currently positioned at a critical junction. If the stock breaks the resistance at ₹661.50, it could indicate a strong upward rally with room for further gains. However, if the stock consolidates or retraces, the ₹620-650 support range could offer a safe entry point for new investors.

From a fundamental perspective, the company’s solid market position, consistent profit growth, and healthy financials make it an attractive long-term investment. In comparison to its peers, Ram Ratna Wires offers a balanced mix of growth and stability, with room for future expansion in both domestic and international markets.

Conclusion

Ram Ratna Wires Ltd offers a unique investment opportunity with strong fundamentals and a favorable technical setup. For long-term investors, the company’s consistent performance, market leadership, and dividend payouts make it a sound addition to any portfolio. Meanwhile, traders can keep an eye on key support and resistance levels for potential short-term gains.

As always, investors should conduct thorough research or consult with financial advisors before making any investment decisions.