Ganesha Ecosphere Ltd (BSE: 514167, NSE: GANECOS) is one of India’s largest and most recognized PET waste recycling companies, known for its leadership in producing Recycled Polyester Staple Fibre (RPSF), spun yarn, and dyed texturized yarn. Over the years, the company has built a robust reputation in the recycling sector, and as of October 2024, it boasts a stock price of ₹1,961. The company’s role in sustainable recycling and its alignment with the growing global interest in sustainability have drawn the attention of both institutional and retail investors.

In this blog, we will take a deep dive into the factors that might influence Ganesha Ecosphere’s future stock price movements, examining both the potential opportunities and the risks associated with the company.

1. Sectoral Tailwinds: The Growing Recycling Industry

Sustainability as a Global Trend

With increasing awareness of environmental issues, there is a worldwide push toward sustainability, with companies across various sectors pivoting to eco-friendly practices. The Indian government, in particular, is focused on promoting green industries, with a strong emphasis on waste management, renewable energy, and recycling. Ganesha Ecosphere’s business model, which focuses on recycling PET (polyethylene terephthalate) bottles and converting them into polyester fiber, places the company at the heart of this trend.

Key Growth Drivers:

- Plastic Ban Policies: With India’s push toward banning single-use plastics, the demand for recycled PET products is likely to see strong growth in the coming years.

- Circular Economy Initiatives: As businesses increasingly adopt circular economy models, demand for recycled polyester fibers, such as those produced by Ganesha Ecosphere, is expected to rise.

These trends are likely to boost the company’s top line, increasing profitability over the long term, which could push the stock price higher.

2. Strong Market Position

Ganesha Ecosphere is the largest PET bottle recycling company in India, contributing to 16%-18% of the country’s total PET bottle waste recycling. This leadership position gives the company several competitive advantages, including:

- Economies of Scale: As the largest player in a growing sector, Ganesha Ecosphere benefits from cost efficiencies that smaller competitors cannot match.

- Extensive Supplier Network: The company’s longstanding relationships with suppliers give it a consistent stream of raw materials, ensuring that it can maintain production even during periods of market volatility.

The company’s leadership position could continue to propel its revenue growth, attracting further interest from investors and potentially leading to a higher stock price.

3. Financial Performance and Valuation Concerns

Current Financial Snapshot

- Market Cap: ₹4,965 Cr.

- Stock P/E Ratio: 83.2

- ROCE: 8.03%

- ROE: 4.82%

- Book Value: ₹400

While Ganesha Ecosphere has demonstrated a strong market presence, its financial metrics raise certain concerns. The high price-to-earnings (P/E) ratio of 83.2 suggests that the stock may be overvalued relative to its earnings. Additionally, the Return on Equity (ROE) of 4.82% and Return on Capital Employed (ROCE) of 8.03% indicate that the company has relatively low profitability compared to its valuation. For many investors, these figures may signal a need for caution when considering future price appreciation.

Debt Reduction and Improved Financial Stability

On the positive side, Ganesha Ecosphere has worked to reduce its debt, which is a positive sign for future cash flows and profitability. A lower debt burden can lead to better earnings per share (EPS) and improved investor confidence, both of which can contribute to upward price momentum.

However, the stock is currently trading at 4.9 times its book value, which could be a red flag for value investors. The company would need to deliver strong growth in earnings and margins to justify this premium.

4. Challenges and Risks

Low Dividend Yield and Promoter Holding Decline

One of the major concerns for investors is the company’s low dividend yield of 0.15%. Dividend payouts have also been low historically, with only 10.7% of profits being distributed over the past three years. For investors looking for regular income from dividends, this could be a deterrent.

Additionally, the promoter holding has decreased by 5.7% over the last three years, which might raise questions about the promoter’s confidence in the company’s long-term growth prospects.

Low Return on Equity and High Valuation

As mentioned earlier, the company’s ROE stands at 4.82%, which is considered low, especially when compared to its high P/E ratio. This implies that the company is not generating a significant return on shareholders’ investments. If the company cannot improve its profitability metrics, its stock price may struggle to sustain its current high valuation.

Volatility in Raw Material Prices

Ganesha Ecosphere’s business model relies heavily on the procurement of PET bottle waste as its primary raw material. Any volatility in the price or availability of this input could adversely affect the company’s margins. For instance, changes in global oil prices, which affect the production of virgin PET, could influence the prices of recycled PET.

5. Expansion Plans and Technological Advancements

Capacity Expansion

The company has been actively investing in expanding its recycling capacity, both within India and in international markets. It is planning to set up new recycling facilities, which will allow it to scale up its operations. An increase in production capacity will likely lead to higher revenues and potentially greater profitability, assuming demand continues to grow.

Technological Innovations

Ganesha Ecosphere is also focusing on upgrading its technological capabilities, particularly in the areas of polymer science and sustainable material development. By embracing innovation, the company can improve its operational efficiency and product quality, further solidifying its market leadership. Such advancements could act as key drivers of future growth and, consequently, higher stock valuations.

6. Peer Comparison and Competitive Landscape

In the textiles sector, Ganesha Ecosphere faces competition from companies such as Siyaram Silk Mills, Alok Industries, and AYM Syntex. Ganesha Ecosphere’s P/E ratio of 83.2 is significantly higher than many of its peers, such as Siyaram Silk Mills, which trades at a P/E of 11.39. This disparity in valuation highlights that Ganesha Ecosphere is priced at a premium, likely reflecting the market’s confidence in its growth potential within the green economy.

However, this premium valuation could lead to volatility if the company does not meet growth expectations. Investors should closely monitor earnings reports and quarterly performance to ensure the company is on track to justify its high P/E.

Technical Analysis of GANECOS

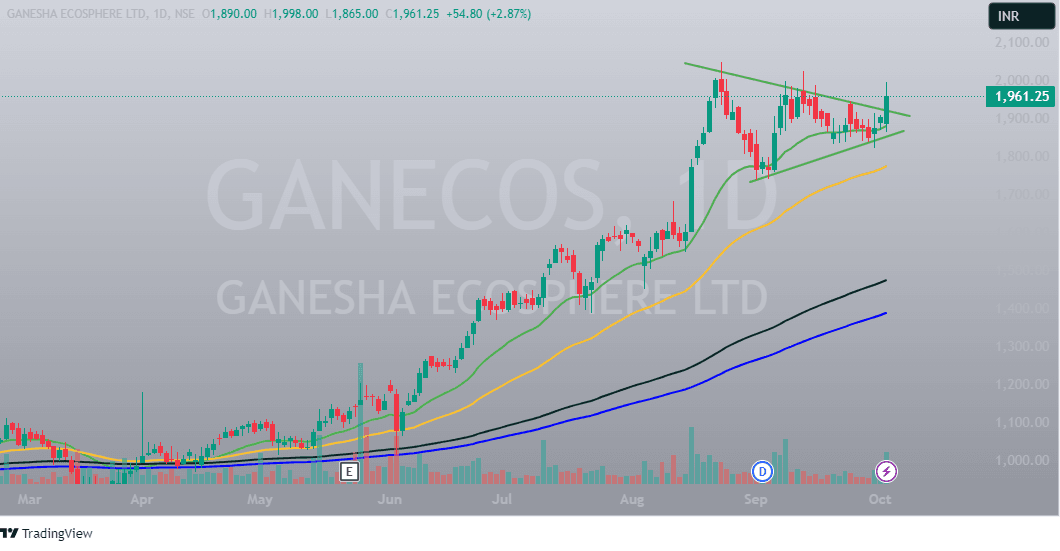

The technical chart of Ganesha Ecosphere Ltd (GANECOS) shows a bullish breakout from a consolidating trend, reflecting a positive signal for future price movement. Here’s an updated analysis of the stock, with a focus on the positive factors that suggest the potential for upward momentum:

1. Bullish Breakout from Consolidation Pattern

The chart highlights a period of consolidation between August and October, with the stock price trading within a symmetrical triangle. This consolidation phase typically signals a pause in the previous trend as investors assess the stock’s direction. As of the recent trading sessions, Ganesha Ecosphere’s stock has successfully broken out of this pattern, indicating a strong bullish sentiment and renewed buying interest. Breakouts from symmetrical triangles are often followed by significant price moves in the direction of the breakout, which in this case, is upwards.

The breakout above the ₹1,950 level suggests that the stock may continue its previous uptrend after successfully breaking through the resistance line. This move could attract further attention from traders and investors who are looking for a continuation of the stock’s rally.

2. Strong Support from Moving Averages

The stock’s price has consistently stayed above its key moving averages:

- 10-day Moving Average (green line): The stock bounced off this level during the recent consolidation phase, showing strong support.

- 50-day and 200-day Moving Averages: These moving averages (black and blue lines) are well below the current price levels, further emphasizing the upward trajectory and overall positive trend.

When a stock price remains above its major moving averages, it is typically considered to be in a bullish phase. These moving averages act as key support levels, and their upward slope suggests that Ganesha Ecosphere’s stock may continue to find strength in future price movements.

3. Volume Indicating Strong Momentum

During the breakout from the triangle pattern, there is a noticeable increase in trading volume, indicating that buyers are stepping in to drive the stock higher. Volume spikes during a breakout are a strong confirmation of price movement, suggesting that the rally is supported by widespread market participation.

This increase in volume is a critical factor that adds conviction to the bullish breakout and suggests that the price movement is likely to sustain in the coming days or weeks.

4. Trend Continuation with Higher Highs and Higher Lows

Ganesha Ecosphere’s stock has been forming higher highs and higher lows consistently since June 2024, a classic indicator of an uptrend. The ability to sustain this pattern over several months demonstrates strength in the stock’s price action, reflecting strong investor confidence and sustained buying pressure. The recent breakout from consolidation is likely to continue this pattern, leading to further gains.

5. Potential Target Based on Triangle Breakout

The height of the triangle pattern provides a potential price target for the next leg of the rally. Based on the triangle’s range, the breakout could push the stock price toward the ₹2,100 to ₹2,200 range in the near term, offering a potential upside of 7%-10% from current levels.

Strong Upside Potential After Bullish Breakout

Ganesha Ecosphere Ltd’s stock is showing several technical signs of strength, including a successful breakout from a consolidation phase, strong support from moving averages, increasing volume, and the formation of higher highs and higher lows. These technical factors suggest that the stock is poised for further upside in the near term, with potential price targets ranging from ₹2,100 to ₹2,200.

For investors, the bullish breakout and robust trend continuation make Ganesha Ecosphere an attractive stock to consider, especially in light of the company’s strong position in the recycling sector and alignment with sustainability trends. With strong technical and fundamental factors in play, the stock may continue to rally, offering significant upside potential for those looking to capitalize on its momentum.

Conclusion: What Lies Ahead for Ganesha Ecosphere’s Stock Price?

Ganesha Ecosphere Ltd has several strong growth drivers, including its leadership in the PET recycling sector, increasing global emphasis on sustainability, and expansion plans. However, its high valuation, low profitability metrics, and relatively weak dividend payout pose risks for future price appreciation.

In the near term, the company’s stock price may remain volatile, especially if there are fluctuations in input costs or if the company fails to meet investor expectations for revenue and profit growth. In the long term, Ganesha Ecosphere’s stock could see significant upward movement if it successfully expands its production capacity, improves margins, and capitalizes on the increasing global demand for sustainable materials.

For investors, this stock may be attractive for those with a high-risk tolerance who believe in the company’s long-term potential in the green economy. However, it’s essential to be mindful of the current valuation and monitor the company’s financial performance closely.

Also Read : Stove Kraft Ltd: Is it a SmartBuy ?