As India’s retail sector continues to grow, driven by increasing disposable income and a burgeoning middle class, companies like V-Mart Retail Ltd. are becoming integral players in the value retail space. Focusing on underserved tier-II and tier-III cities, V-Mart has steadily expanded its presence across the country, capitalizing on the growing demand for affordable fashion and general merchandise in smaller markets. With a robust expansion strategy and a value-driven business model, the stock has gained attention from investors. Let’s analyze V-Mart’s stock chart and financials to understand its recent performance and potential.

Strong Price Momentum

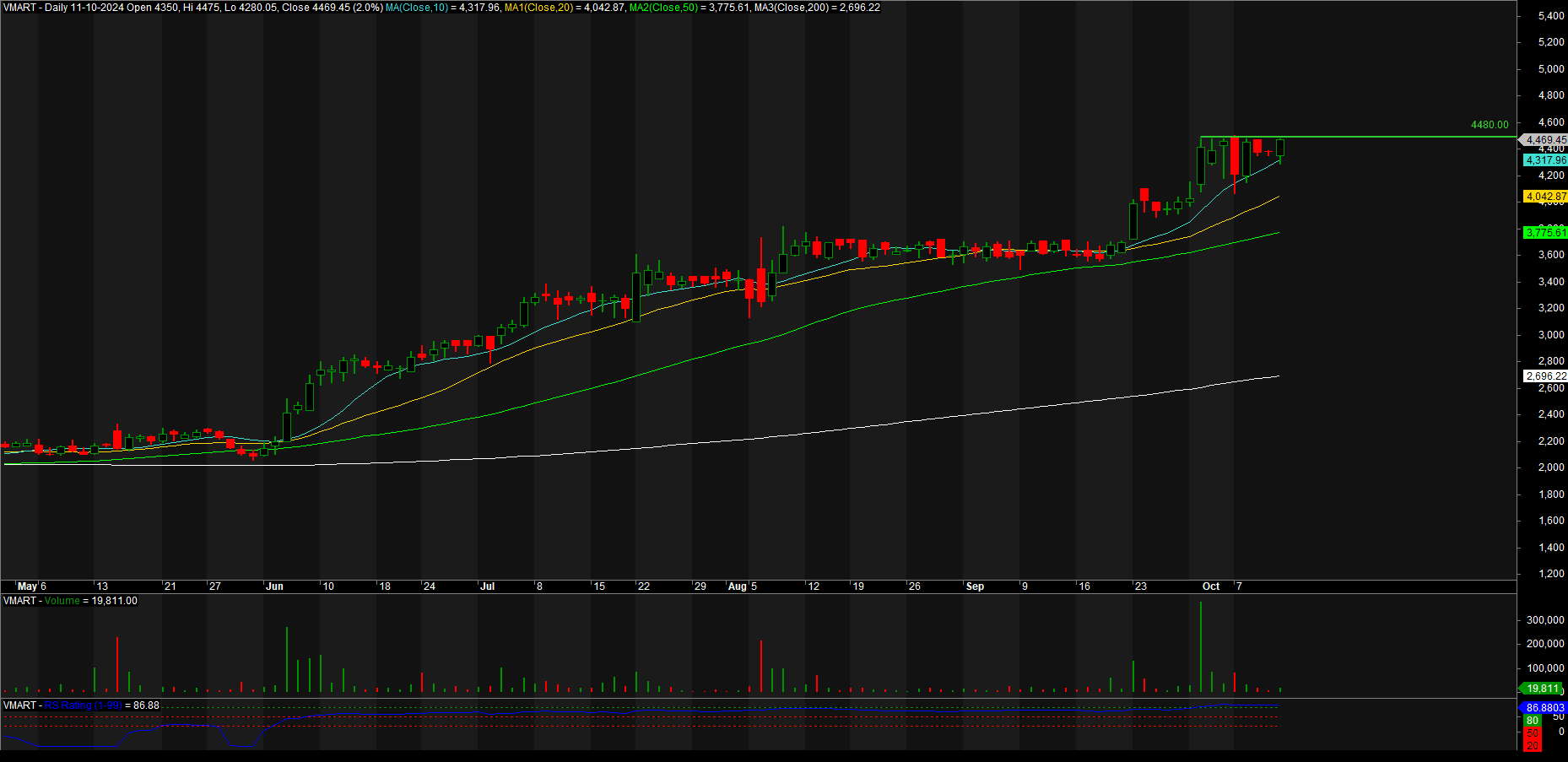

A look at V-Mart’s stock chart, as of October 11, 2024, shows the company’s shares closed at ₹4,469, marking a 2% gain for the day. The stock opened at ₹4,350 and hit an intraday high of ₹4,475, exhibiting significant strength throughout the session.

Since June 2024, V-Mart’s stock has been in a clear uptrend, rising from the ₹3,200 range to its current levels around ₹4,480, a gain of over 40% in just four months. This impressive run has been fueled by strong investor interest and positive sentiment in the retail sector, particularly as the company continues to expand its footprint in untapped markets.

Key Technical Insights

A detailed look at the chart reveals several bullish indicators:

- Resistance and Support Levels: The stock recently tested the ₹4,480 resistance level. A decisive breakout above this price point could set the stage for further gains, potentially pushing the stock into a new higher trading range.

- Moving Averages:

- The 10-day MA is currently at ₹4,317, acting as immediate support.

- The 20-day MA at ₹4,042 further supports the stock, with prices remaining well above both short- and long-term moving averages, indicating strong upward momentum.

- Additionally, the 50-day MA sits comfortably at ₹3,775, providing a solid foundation for the uptrend.

- Volume Analysis: Volume remains steady, with an average daily volume of around 19,811 shares, confirming healthy participation from investors. This shows sustained interest in the stock, particularly during its recent rallies.

- Relative Strength (RS) Rating: With an RS rating of 86.88, V-Mart is outperforming a significant portion of the market, indicating that it is one of the strongest performers in its sector.

Potential Breakout Ahead

The stock has been consolidating just below the critical resistance level of ₹4,480, as seen in the chart. If V-Mart manages to break and sustain above this price, we could witness a sharp move upwards, potentially targeting higher levels. A breakout would signal continued investor confidence and could push the stock toward new highs in the coming sessions.

The RS Rating of 86.88 supports the thesis of further upside, as this indicates strong performance relative to the broader market. Moreover, V-Mart’s moving averages continue to provide solid support, reinforcing the bullish case for the stock.

V-Mart’s Fundamental Outlook

On the fundamental side, V-Mart has been expanding aggressively in smaller towns and cities, which positions it uniquely in the Indian retail space. The company focuses on value retail, offering affordable clothing and general merchandise to consumers in regions often neglected by larger competitors.

- Revenue Growth: While V-Mart has demonstrated strong revenue growth, its profitability remains under pressure. The company reported a ₹64 crore loss in the latest quarter, which highlights the need for better cost management.

- Efficient Working Capital Management: One of the standout metrics for V-Mart is its improvement in working capital management, reducing working capital days from 66.8 days to 40.4 days. This improvement signals a more efficient operational model and better cash flow management.

- Promoter Holding: The promoter’s stake in the company stands at 44.3%, with no shares pledged. This is a strong indicator of confidence from the company’s management and founders, which further bolsters investor confidence.

Read Also : Pharmaceutical Excellence: Why Piramal Pharma Should Be in Your Portfolio

Valuation Concerns

Despite its strong stock performance, V-Mart trades at 11.8 times its book value, which is relatively high, especially when compared to peers such as Avenue Supermarts (DMart) and Trent Ltd. While the stock’s valuation suggests significant optimism about its future growth, investors need to be cautious about the company’s ability to improve profitability.

A high Price-to-Earnings (P/E) ratio in the context of inconsistent earnings growth introduces risk. Investors will be closely monitoring upcoming earnings reports to ensure that V-Mart can justify its premium valuation by improving margins and profitability.

Growth Potential and Risks

V-Mart’s growth story is rooted in its focus on tier-II and tier-III cities, where demand for affordable products continues to grow. The company’s ability to execute its expansion plans effectively will be key to sustaining its current valuation and delivering long-term value to shareholders.

However, the key risks include rising operational costs and competition from both organized and unorganized retailers. Additionally, the company’s inconsistent profit margins could become a red flag if they do not improve over the next few quarters.

Conclusion: A Retail Stock to Watch

V-Mart Retail Ltd. is currently trading near its all-time highs and is poised for a potential breakout above ₹4,480. The stock’s technical indicators suggest strong momentum, and a move above this critical resistance level could lead to further gains. However, investors should remain cautious about its high valuation and monitor the company’s ability to deliver consistent profitability.

For long-term investors looking to gain exposure to India’s rapidly expanding consumer market in smaller cities, V-Mart remains an intriguing prospect. Its focus on value retail in underserved regions offers considerable growth potential, though its high valuation warrants careful consideration.

In conclusion, V-Mart presents a compelling opportunity in the retail space, particularly for investors willing to bet on India’s emerging cities. Keep an eye on the upcoming price action and earnings releases to gauge whether the stock can sustain its upward momentum and breakout to new highs.

Disclaimer: This analysis is for informational purposes and should not be considered financial advice. Always consult with a financial advisor before making any investment decisions.