1. Company Overview & Market Position

AstraZeneca Pharma India Ltd. is a subsidiary of AstraZeneca plc, a leading global pharmaceutical company with a strong portfolio across several therapeutic areas. In India, AstraZeneca focuses on developing and marketing innovative products, with a special emphasis on oncology, cardiovascular, and respiratory medications.

The company’s Indian operations are underpinned by strong R&D backing from its parent company, which is well-known for the COVID-19 vaccine. However, AstraZeneca Pharma India’s financial metrics indicate mixed results, with periods of fluctuation, particularly in the last few quarters.

2. Financials Overview

- Market Capitalization: ₹19,466 Cr.

- Stock P/E Ratio: 149, which is significantly higher than the industry median of 46.57, indicating that the stock is priced at a premium relative to its earnings. While this could signify strong investor confidence, it also means the stock is relatively overvalued.

- Dividend Yield: A modest 0.31%, but the company maintains a healthy dividend payout ratio of 39.3%, signaling a commitment to returning value to shareholders.

- Book Value: ₹285, while the stock is trading at 27.4 times its book value, which indicates a premium valuation. However, this could be justified by its potential for future growth, backed by its strong pipeline and global parent.

3. Profitability Ratios

- Return on Capital Employed (ROCE): A healthy 31.1% shows that the company efficiently uses its capital to generate profit.

- Return on Equity (ROE): 22.9%, which is impressive and reflects the company’s efficiency in generating returns from shareholder equity.

Despite these strong metrics, the company’s net profit margin saw a steep decline in recent quarters. For the quarter ending June 2024, AstraZeneca Pharma India posted a loss of ₹12 Cr, with its EPS dropping to -₹4.72. The drop can be attributed to higher operating expenses and volatile profit margins, which might raise red flags for short-term investors.

4. Debt Levels

One of Astrazeneca Pharma’s strengths is its almost debt-free status, with a low borrowing figure of ₹5 Cr. A minimal debt level positions the company to better withstand financial downturns, as it does not have high-interest obligations, providing more flexibility for reinvestment in growth initiatives.

5. Long-Term Growth

- Sales Growth: Astrazeneca Pharma’s compounded sales growth stands at 30% (TTM), and it has achieved a profit growth of 18% over the last 3 years, positioning the company as a strong long-term play. The company’s growth is expected to accelerate due to its innovative product pipeline and its strategic focus on high-demand therapeutic segments.

- Shareholding Pattern: With 75% of shares held by the promoter group (AstraZeneca plc), and no pledging of shares, the parent company demonstrates strong confidence in its Indian subsidiary. Furthermore, FII and DII holdings have been gradually increasing, a positive sign of institutional confidence.

Technical Analysis

1. Price Performance & Trend Analysis

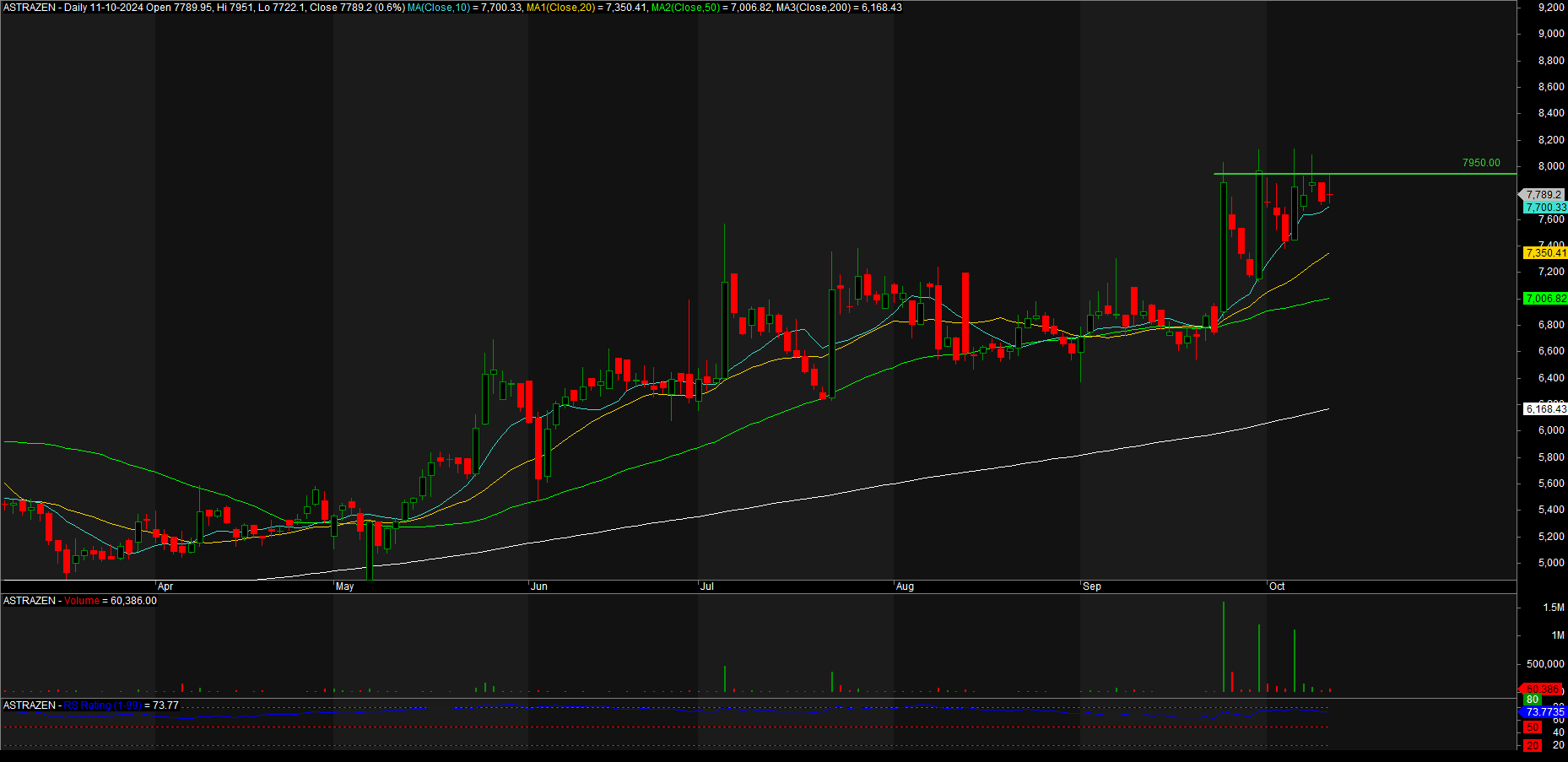

The current stock price of ₹7,789 is closer to its 52-week high of ₹8,140, reflecting strong buying interest in recent months. However, the stock has also experienced significant volatility, with a 52-week low of ₹4,050. Over the past year, AstraZeneca Pharma India has delivered stellar returns, with a 1-year return of 67% and a compounded annual growth rate (CAGR) of 35% over 3 years.

The stock is currently trading at a P/E of 149, significantly above the industry average. This suggests that the stock is highly valued, and future earnings growth may already be priced in. Caution is warranted for short-term traders, as any downward revision in earnings expectations could lead to a price correction.

2. Moving Averages

- 50 DMA: The stock is trading well above its 50-day moving average (DMA), signaling strong upward momentum.

- 200 DMA: The stock is also above its 200-day moving average, which is a bullish sign for long-term investors.

3. Momentum Indicators

The stock’s RSI (Relative Strength Index) is hovering around the overbought zone, signaling potential short-term weakness. Investors looking to accumulate should wait for a potential correction before entering.

Read Also : Medicamen Biotech Stock Analysis

4. Volume Trends

Recent trading volumes have shown an uptick, indicating increased investor interest. However, with the stock nearing its 52-week high, a pullback could be expected as investors may look to book profits. A break above the ₹8,140 resistance level could trigger further upside, while support lies around the ₹6,800-₹7,000 levels.

Key Observations for the VCP:

- Multiple Contractions in Price: The stock is displaying the characteristics of a VCP. After a rally, the price has started contracting in multiple waves. The highest price contraction level appears around ₹7950, which marks the upper resistance level where the stock price has consistently faced resistance. Each pullback after touching resistance appears to contract with lower volatility than the previous one, indicating accumulation and preparation for a breakout.

- Support Levels: The moving averages (MA10, MA20, MA50, MA200) are sloping upward, especially the shorter-term MAs (MA10, MA20), which indicate continued bullish momentum and support underneath. The stock bounced back off of these moving averages in each contraction phase, reinforcing the idea of rising support and reduced selling pressure.

- Volume Trends: The VCP pattern is also characterized by declining volume during contractions. In this chart, the volume appears to shrink during the pullback phases, showing that sellers are less aggressive and indicating a drying up of supply. A breakout typically occurs on increased volume, and the current volume levels provide insight that a surge might follow with a breakout above the resistance level.

- Price Consolidation and Resistance: The most recent price action shows that the stock is near its upper resistance at ₹7950. With reduced volatility, the price is getting squeezed into a tighter range, a key feature of the VCP. If the stock breaks through this upper resistance with significant volume, it would confirm a breakout.

- RS Rating: The Relative Strength (RS) rating of 73.77 is decent, indicating the stock has been outperforming many in the market. A higher RS rating combined with a breakout from this VCP could make this stock a compelling trade.

Pros and Cons

Pros

- Debt-free status: The company’s low debt gives it flexibility to reinvest profits in R&D and expansion.

- Strong ROE & ROCE: Solid returns for shareholders, showing efficient capital use.

- Healthy dividend payout: The company has a good dividend payout ratio of 39.3%, even though the yield is modest.

- Institutional confidence: Steadily increasing FII and DII holdings.

Cons

- High Valuation: The stock is trading at a P/E of 149, significantly above its peers, signaling that a lot of growth is already priced in.

- Fluctuating profits: Recent quarters have seen volatile profit margins, with a notable loss in Q2 2024.

- Overbought technicals: The RSI indicates that the stock may be due for a short-term correction.

Conclusion

AstraZeneca Pharma India Ltd. presents a mixed picture for investors. On the fundamental side, the company’s strong parentage, excellent ROE and ROCE, and debt-free status make it an attractive long-term investment, especially with its focus on high-growth pharmaceutical sectors. However, the stock’s premium valuation and recent volatility in earnings call for caution, particularly for short-term investors.

From a technical standpoint, while the upward trend remains intact, momentum indicators suggest that a correction may be on the horizon. Investors looking to build a position may want to wait for a pullback before entering, while those with a long-term horizon can rely on AstraZeneca’s solid business fundamentals and promising growth trajectory in India’s expanding pharmaceutical market.

For those seeking a blend of stability, innovation, and growth, AstraZeneca Pharma India Ltd. remains a compelling investment, albeit with the need for careful timing.