Introduction

Incorporated in 2016, Kotyark Industries Ltd (NSE – SME: KOTYARK) is a frontrunner in India’s biodiesel manufacturing sector. Dedicated to producing green energy alternatives, Kotyark plays a vital role in India’s shift toward sustainable development and renewable resources. As the nation’s only publicly traded biodiesel company, Kotyark Industries is positioned uniquely to tap into the growing demand for alternative fuels. In this blog, we’ll explore Kotyark’s operations, growth trajectory, and future prospects as it helps drive India’s biodiesel revolution.

Table of Contents

Business Overview

Kotyark operates in the renewable energy sector, focusing on biodiesel and sustainable resource development. The company’s environmentally friendly technology helps reduce greenhouse gas emissions across various sectors, including public and private transportation, heavy equipment, and generator sets. Kotyark’s commitment to eco-friendly fuel alternatives highlights its role as a catalyst for change in India’s energy landscape.

Product Portfolio

Kotyark Industries has two primary products:

- Biodiesel: Known as B100 or neat biodiesel, this eco-friendly liquid fuel meets the Renewable Fuel Standard, aligning with biomass-based diesel and advanced biofuel requirements.

- Glycerin: A by-product of biodiesel production, glycerin is utilized in the food, pharmaceutical, and cosmetic industries. For every 100 liters of biodiesel produced, approximately 14 liters of crude glycerin is generated, enhancing Kotyark’s product diversity.

Production Facilities and Capacity

Kotyark’s biodiesel production facilities reflect its commitment to sustainable operations. With a zero-effluent discharge setup, the company operates two plants:

- Sirohi, Rajasthan: 500 KL per day capacity.

- Anand, Gujarat: 100 KL per day capacity.

Together, these facilities bring Kotyark’s total annual biodiesel capacity to approximately 219,000 KL and 25,550 MT of glycerin.

Key Clients and Distribution Channels

Kotyark supplies its biodiesel to multiple customer segments:

- Oil Marketing Companies (OMCs): Including major players like Indian Oil, HPCL, and BPCL.

- Bulk Buyers: Industries that require large quantities of biodiesel, such as transportation, mining, and manufacturing sectors.

- Mobile Retail Outlets (MROs): The company operates 25 MROs along major highways under its ‘Green N Green’ brand, delivering biodiesel directly to consumers through a dealership model.

Technical Analysis

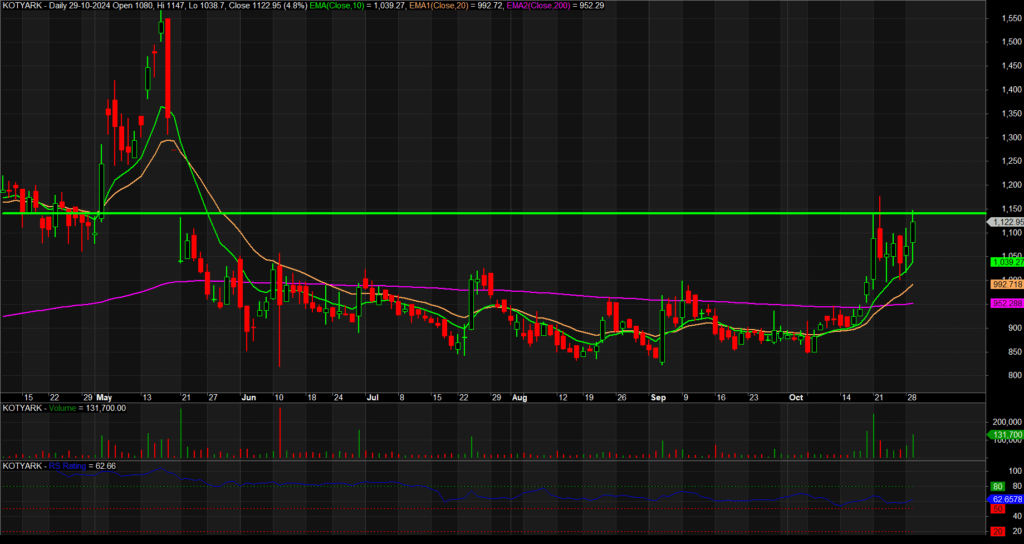

- Support and Resistance Levels: The price recently rallied up to the 1150 level, which appears to be a significant resistance. This level was tested previously, making it a critical zone to watch for future price action.

- Moving Averages:

- The 10-day EMA (green line) is above the 20-day EMA (orange line) and both are trending upwards, indicating short-term bullish momentum.

- The 200-day EMA (purple line) sits below current price levels, signaling a strong uptrend from a longer-term perspective.

- Volume: There is an increase in volume during the recent uptrend, showing that buyers are actively participating in the move. However, volume is slightly tapering off near the resistance, suggesting some profit-taking or cautious buying at these levels.

- Relative Strength (RS) Rating: The RS rating is currently around 62, which indicates moderate relative strength compared to the broader market. This suggests potential for continued outperformance if the uptrend sustains.

- Price Action: The recent price movement suggests that buyers are challenging the 1150 resistance, but it may require more accumulation before a clear breakout.

My Expectation: I am expecting consolidation near 1150 for a few days, allowing the stock to gather strength. If a breakout occurs above this level with volume, it could lead to a significant up move, potentially initiating a strong new trend upwards.

This consolidation and breakout pattern could provide an ideal entry point for momentum traders, especially if the stock holds above its short-term moving averages during the consolidation phase.

Financial Performance

In recent years, Kotyark Industries has displayed significant growth in revenue, profitability, and asset base:

- Revenue Growth: Kotyark reported a robust 107% year-over-year increase in revenue, reaching ₹270.99 crore in FY24. This growth was fueled by increased biodiesel blending requirements from OMCs.

- Profit Margins: Operating margins rose impressively to 17%, highlighting Kotyark’s operational efficiency. Profit after taxes also jumped by 55% to ₹22.24 crore, despite minor setbacks from delayed procurement processes from some OMCs.

Key Financial Metrics

The company’s financial indicators underscore its strong market position:

- Return on Capital Employed (ROCE): 23.9%, reflecting efficient asset utilization.

- Return on Equity (ROE): 20.6%, showcasing healthy profitability relative to shareholder equity.

- Debt-Equity Ratio: The debt-equity ratio has increased slightly, indicating a reliance on borrowing to finance expansion. However, the company’s debt service coverage remains stable.

Growth Drivers

Several factors position Kotyark Industries for sustained growth in the years to come:

- Government Policy: India’s National Policy on Biofuels targets a 5% biodiesel blend by 2030. Supportive measures include a reduction in GST rates on biodiesel and incentives for blending programs.

- Capacity for Expansion: Kotyark’s plants operate at low utilization rates, providing substantial headroom for future output increases without significant capital investments.

- Verra Accreditation: Kotyark is the first biodiesel company in India to receive Verra accreditation, a globally recognized carbon certification. This accomplishment opens opportunities for carbon credit sales, further enhancing revenue potential.

Recent Developments

- New Orders: In FY23, Kotyark secured substantial biodiesel supply orders worth ₹740 crore from IOC, HPCL, and BPCL. Additionally, an order worth ₹63.85 crore was received for 7,851 KL of biodiesel, set for delivery between April and September 2024.

- Expansion of Share Capital: The company increased its authorized share capital from ₹9 crore to ₹16 crore to support its growth ambitions.

- Exemption in Rajasthan: In January 2023, Kotyark obtained a five-year exemption from electricity duty and a 75% exemption from state GST, further reducing operational costs.

Pros and Cons of Investing in Kotyark

Pros

- High Growth Rate: The company has delivered a five-year profit growth of 108% CAGR.

- Solid ROE Track Record: With a three-year average ROE of 25.8%, Kotyark has consistently rewarded shareholders.

- Healthy Dividend Payout: Kotyark’s dividend payout ratio stands at 29.1%, a sign of strong cash flows and shareholder-friendly policies.

Cons

- Valuation Concerns: Kotyark is trading at 8.01 times its book value, which is high relative to industry averages.

- Rising Debtor Days: The debtor days have increased from 33.7 to 46.4, indicating slower collections.

- High Stock P/E Ratio: A stock P/E of 50.8 makes the stock relatively expensive.

Read Also : Anup Engineering Share Analysis

Peer Comparison

Compared to other players in the miscellaneous industry, Kotyark stands out for its growth metrics and sustainable business model. However, it faces competition from established energy companies and alternative fuel providers, which may limit its market share expansion.

Future Outlook

Kotyark Industries’ future prospects look bright, fueled by government initiatives, increasing demand for alternative fuels, and its substantial unused capacity. The company’s focus on research and development, alongside its commitment to sustainability, strengthens its competitive edge in a growing market.

In summary, Kotyark Industries Ltd is positioned strategically in India’s green energy sector. With its sustainable production methods, focus on high-demand sectors, and a robust product portfolio, Kotyark is well-prepared to play a pivotal role in India’s transition toward a low-carbon economy. However, investors should be mindful of the company’s high valuation and expanding debtor days. Overall, Kotyark remains an exciting growth story in India’s energy landscape.