Skipper Limited, a key player in the power transmission and distribution sectors in India, has drawn attention from investors due to its promising chart patterns and improving fundamentals. With the ever-increasing demand for power infrastructure in the country, companies like Skipper are positioned to capitalize on growth opportunities. This blog delves into both the technical setup and fundamental growth of Skipper Limited, offering a comprehensive analysis for potential investors.

Table of Contents

Technical Analysis

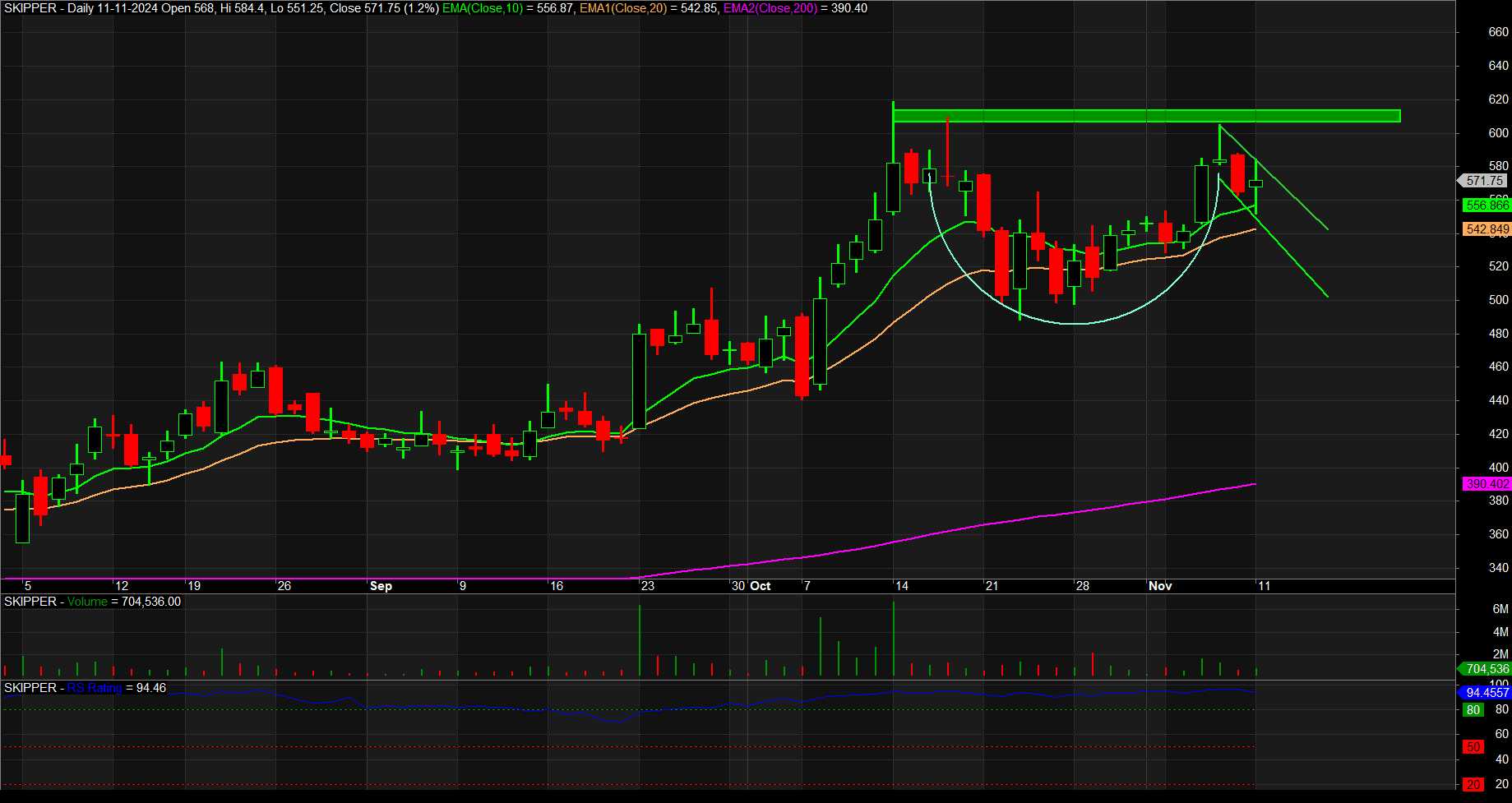

Examining the chart of Skipper Limited reveals some intriguing technical formations.

Daily Chart of Skipper Limited

- Cup and Handle Formation:

- The chart displays a classic cup and handle pattern, typically a bullish continuation pattern. It indicates a period of consolidation followed by a breakout attempt, suggesting potential for further upward movement.

- This formation often signals that a stock is preparing for a rally after a period of strength and consolidation. The recent price action aligns with this interpretation, as Skipper attempted to break above the resistance level but met some selling pressure, forming the handle.

- Resistance and Support Levels:

- The highlighted green zone in the chart represents a strong resistance level around the ₹600 mark. If Skipper manages to breach this level with strong volume, it could indicate the beginning of a new uptrend.

- The 10-day and 20-day exponential moving averages (EMAs) are positioned below the current price, providing short-term support and reflecting an upward momentum.

- Volume and Relative Strength:

- The recent increase in volume during the upward moves suggests strong buying interest in the stock. This volume surge aligns with the potential breakout scenario.

- Additionally, the Relative Strength (RS) rating is high, showing that Skipper is outperforming a significant portion of the market, which adds to the bullish outlook.

- Price Channel:

- Skipper appears to be consolidating within a downward-sloping channel post-breakout attempt, a common occurrence in the handle formation. A breakout above the channel could confirm the bullish pattern.

Fundamental Analysis

Beyond technicals, Skipper’s financial performance and sectoral positioning provide a strong foundation for its bullish outlook.

Revenue and Profit Growth

- Rising Sales:

- Skipper Limited has reported consistent growth in its sales revenue over recent quarters. The company has benefited from increased infrastructure spending in India, particularly in the power transmission and distribution sectors.

- The focus on rural electrification and expansion of urban power grids has spurred demand for Skipper’s products, leading to robust order books and a promising sales trajectory. This increase in sales reflects the company’s growing market share and ability to capture larger contracts.

- Improving Profit Margins:

- The company’s profit margins have shown steady improvement, driven by cost efficiency measures and better project management. This reflects Skipper’s focus on enhancing operational efficiency and maintaining a competitive edge in a price-sensitive market.

- Recent financial reports show that net profit has grown significantly, with higher gross margins reflecting reduced costs and better pricing strategies.

- Debt Reduction:

- Skipper has made significant efforts to manage and reduce its debt. Lower debt levels improve financial stability and reduce interest expenses, allowing the company to allocate more resources toward growth initiatives.

- Improved debt ratios enhance the company’s credit profile and may lead to better financing options, contributing to its long-term growth potential.

- Strong Order Book:

- Skipper’s order book has seen substantial growth, indicating a strong pipeline of projects. This backlog of orders provides revenue visibility and reduces dependency on short-term fluctuations in new contracts.

- The company’s projects include various government and private sector contracts, which diversify its revenue streams and reduce risk.

Sectoral Tailwinds

Skipper Limited is positioned within a sector that benefits from favorable macroeconomic factors:

- Infrastructure Expansion:

- India’s emphasis on infrastructure development, including smart cities and enhanced power grid networks, bodes well for companies like Skipper. The government’s initiatives in rural electrification and urban power distribution expansion will likely increase demand for Skipper’s products and services.

- Focus on Renewable Energy:

- With India’s increasing focus on renewable energy, transmission companies are essential for integrating renewable power sources into the grid. Skipper’s products and services cater to this growing need, placing it in a strategic position to benefit from the renewable energy sector’s expansion.

Read Also : Is NALCO Set for a Breakout ? Key Levels and Insights for Investors

Risks and Challenges

While Skipper Limited shows promise, investors should consider potential risks:

- Competition in the Sector:

- The power transmission and distribution sector is competitive, with multiple players vying for government and private sector contracts. Price competition could impact Skipper’s margins.

- Dependency on Government Policies:

- Skipper’s growth depends significantly on government spending and policies related to infrastructure. Any change in these policies or delays in infrastructure projects could impact the company’s performance.

- Commodity Price Volatility:

- Since Skipper deals with raw materials like steel and other metals, fluctuations in commodity prices could impact its profit margins.

Conclusion

Skipper Limited presents a compelling investment case, with strong technical indicators and improving fundamentals. The bullish cup and handle pattern, supported by high relative strength, points to possible upward momentum if it breaks through key resistance levels. On the fundamental side, Skipper’s rising sales, improving profit margins, and strong order book suggest that it is well-positioned to capitalize on growth opportunities in India’s expanding power infrastructure sector.

For investors, Skipper Limited offers a mix of technical and fundamental appeal. However, it is essential to consider sector-specific risks and monitor the company’s performance and market conditions closely. If Skipper can break through its resistance level with strong volume, it could be poised for a significant upward trend, rewarding long-term investors who believe in its growth story.