Stove Kraft Ltd, a major player in the Indian kitchen appliance market, has caught the attention of investors with its consistent growth and strong presence. The company, founded in 1999, manufactures products under three brands: Pigeon (value segment), Gilma (semi-premium), and BLACK+DECKER (premium). Despite its promising expansion, certain financial indicators raise questions about whether the stock is overvalued or worth holding for long-term gains.

Key Highlights:

- Leading Kitchen Appliance Manufacturer: Stove Kraft has made a name for itself in kitchen solutions, being the third-largest player in the non-stick cookware market with a 12% market share. Its product range includes pressure cookers, cooktops, hobs, and more, making it a household name in India.

- Consistent Revenue Growth: The company’s sales have steadily grown over the years, reaching ₹1,361 Cr in FY24. This is an impressive jump from earlier years, reflecting robust demand for its products.

- Brand Diversification: With a portfolio ranging from budget-friendly Pigeon products to premium BLACK+DECKER appliances, Stove Kraft caters to a wide customer base. This diversification has helped the company stay competitive in the domestic appliance market.

Financial Overview:

As of October 2024, Stove Kraft’s stock price is around ₹898, with a market cap of ₹2,967 Cr. However, the stock is trading at a PE ratio of 86.9, which suggests a possible overvaluation. For comparison, many companies in the Consumer Durables sector have a much lower PE ratio.

ROE (Return on Equity) for the last three years stands at 8.32%, which is relatively low, and the ROCE (Return on Capital Employed) is 11.3%. While these figures indicate positive returns, they don’t compare favorably to more established competitors like TTK Prestige and Whirlpool India, whose ROCE exceeds 14%.

Stock Performance:

Stove Kraft’s stock has more than doubled in value over the past year, benefiting from a strong investor sentiment towards consumer durables and home appliances. Despite this bullish trend, some caution is warranted. The stock is currently trading at 6.75 times its book value, suggesting that it may be priced beyond its fundamentals.

Additionally, the company has a promoter pledge of 14.6%, which can be a red flag for risk-averse investors. Companies pledging promoter shares often indicate financial stress, though Stove Kraft has not shown immediate signs of such distress.

Peer Comparison:

When compared to industry giants like Whirlpool India, TTK Prestige, and Bajaj Electricals, Stove Kraft’s financial metrics, particularly profitability, lag behind. For instance, Whirlpool and TTK Prestige have a higher ROE and dividend yield, while Stove Kraft’s dividend yield is a mere 0.28%.

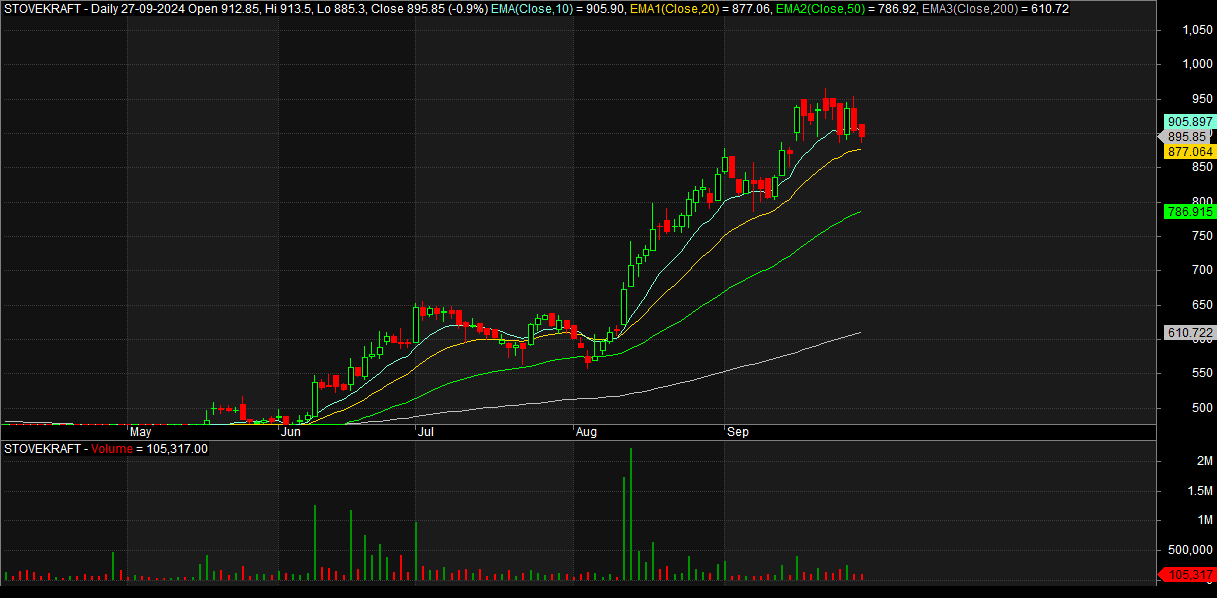

- Trend:

- The stock has shown an impressive rally since June 2024, with prices moving from the sub-₹600 range to recent highs above ₹950, marking significant upward momentum.

- The price has now entered a consolidation phase around ₹900, after touching highs around ₹968.

- Support and Resistance Levels:

- Support: The price seems to be respecting the 20-day Exponential Moving Average (EMA) at ₹877.06. This is a critical level for near-term support.

- Resistance: The recent high at ₹968 will act as a major resistance level. If the stock breaks through this, it could continue its upward momentum.

- Moving Averages:

- The stock is currently trading well above the 50-day EMA (₹786.92) and 200-day EMA (₹610.72), suggesting that the longer-term trend is strongly bullish.

- However, in the shorter term, the price is approaching the 20-day EMA. If it breaks below this level, we might see further downside towards the 50-day EMA near ₹786.

- Volume:

- The volume (105,317) appears to be lower in the consolidation phase compared to the earlier part of the rally. This suggests that the current phase might be a temporary pause or a slight correction before the stock resumes its upward movement.

- Indicators:

- The presence of a consolidation pattern suggests that traders are awaiting a breakout or breakdown. A close above ₹968 may lead to a renewed rally, while a break below ₹877 could signal a deeper correction.

Conclusion:

- Bullish outlook: If the stock holds above the 20-day EMA and breaks above ₹968, it could resume its upward trend.

- Bearish scenario: A break below the 20-day EMA could result in a deeper pullback towards the ₹800-₹785 range.

As with all stock trading, risk management is key. Setting stop-losses near support levels and observing volume and price action closely will help mitigate risks in case of a reversal.

Comments are closed.