Ami Organics Ltd, a leading research-driven specialty chemical manufacturer, has carved a niche for itself in the pharmaceutical and specialty chemical space. With a robust product portfolio, expanding global reach, and a focus on innovation, the company is poised to capitalize on emerging trends in healthcare, agrochemicals, and renewable energy. This blog explores its business model, financial performance, strategic initiatives, and future prospects in detail.

Table of Contents

Business Overview

Founded with a vision to provide high-quality specialty chemicals, Ami Organics has established itself as a key player in the manufacturing of Advanced Pharmaceutical Intermediates, Active Pharmaceutical Ingredients (APIs), and specialty chemicals. The company’s products cater to diverse industries, including pharmaceuticals, cosmetics, dyes, polymers, agrochemicals, and battery electrolytes.

- Product Portfolio: Over 520 products developed and commercialized, spanning 50+ countries and catering to over 500 customers.

- Business Segments:

- Pharma Intermediates: Constituting 76% of revenues in 9MFY24 (down from 97% in FY20), this segment includes over 185 intermediates used in 17 therapeutic areas, commanding 50-90% global market share for key molecules.

- Specialty Chemicals: Contributing 24% of revenues in 9MFY24 (up from 3% in FY20), the company has diversified into parabens, salicylic acid, and electrolyte additives for batteries, becoming the first non-Chinese company in this space.

Financial Snapshot

Stock Performance

- Current Price: ₹2,068 (as of 18th Nov 2024)

- Market Cap: ₹8,470 Cr

- High/Low (52 weeks): ₹2,150 / ₹1,004

- PE Ratio: 90.7

- Book Value: ₹294

- Dividend Yield: 0.15%

Financial Ratios

- Return on Capital Employed (ROCE): 16.0%

- Return on Equity (ROE): 9.37%

- Debt: Almost negligible, indicating strong financial stability.

Quarterly Revenue Growth

- Revenue Growth: Sales grew from ₹122 Cr in Sep 2021 to ₹247 Cr in Sep 2024, showcasing a CAGR of over 28%.

- Net Profit: Jumped from ₹17 Cr in Sep 2021 to ₹38 Cr in Sep 2024, highlighting effective cost management.

Export Revenue

Exports contributed 61% of revenue in Q3FY24, up from 46% in FY20, with Italy, Finland, Spain, and Israel accounting for 75%-80% of the export share.

Strategic Initiatives

- Capacity Expansion

The company has strategically expanded its manufacturing capabilities:- A new brownfield facility in Ankleshwar, Gujarat, inaugurated in Dec 2023, increased reactor capacity by 436 KL.

- Total capex for FY23 was revised to ₹310 Cr to support CDMO operations.

- Electrolyte Business

Ami Organics has entered the high-potential battery materials space:- Signed an MoU with a global electrolyte manufacturer for battery cell materials.

- Committed ₹300 Cr for a new manufacturing facility in Gujarat, aligning with the electric vehicle boom.

- Acquisition of Baba Fine Chemicals

In April 2023, the company acquired a 55% stake in Baba Fine Chemicals for ₹68.2 Cr. This acquisition enhances its foothold in high-value specialty chemicals, particularly for the semiconductor industry. - Contract Development and Manufacturing Organization (CDMO)

- Signed agreements with Fermion in 2022 and 2023 for the production of advanced intermediates.

- These contracts, coupled with the Ankleshwar facility, position Ami Organics as a long-term partner for global pharmaceutical giants.

- Focus on Sustainability

Awarded a Gold Medal by EcoVadis, placing it among the top 5% globally for sustainability efforts.

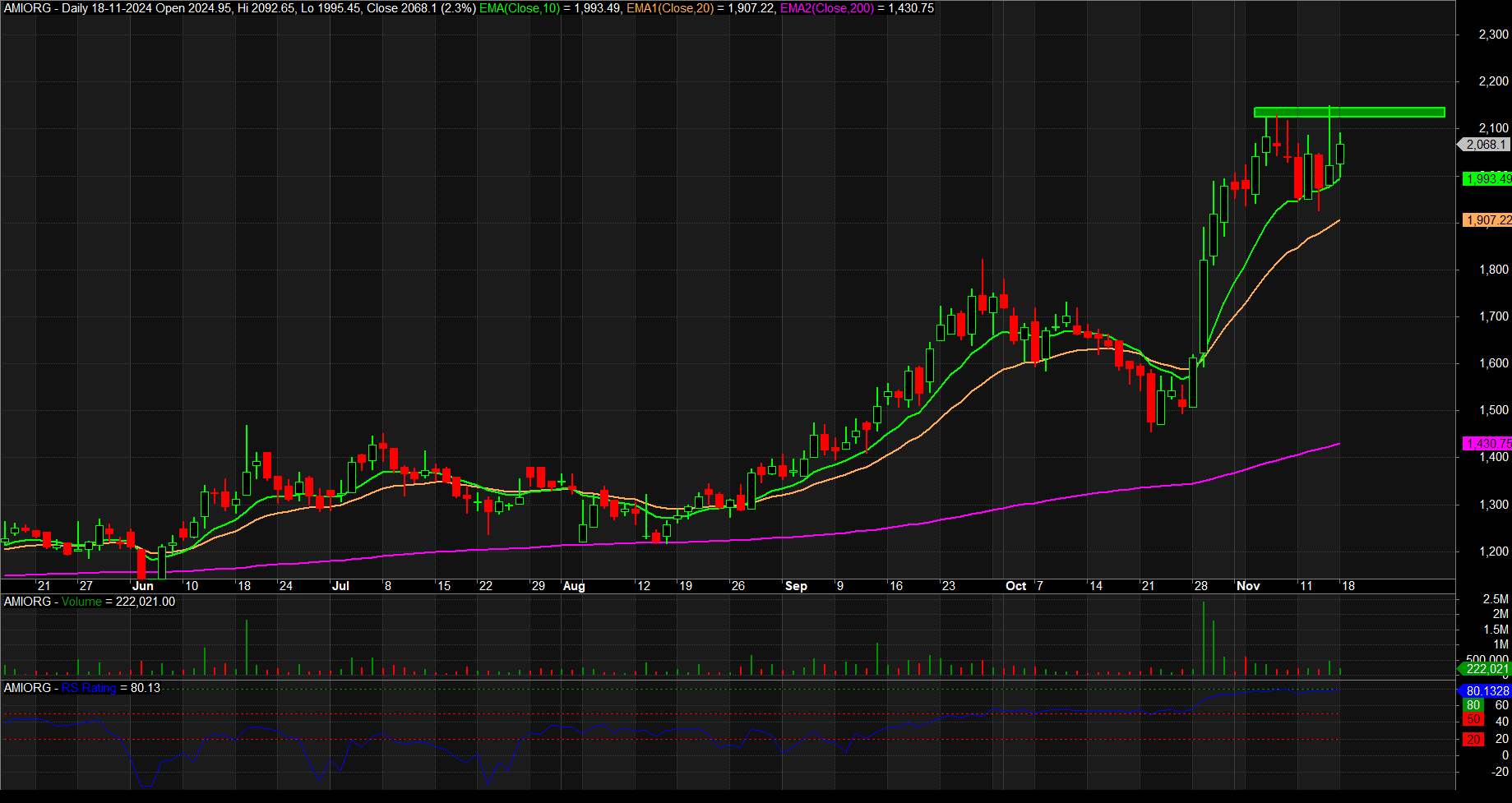

Technical Snapshot

- Price Action:

- The stock is in a clear uptrend, with a strong rally since late October, reflecting bullish momentum.

- A potential resistance zone is visible near ₹2,100, where the stock has faced rejection multiple times, as indicated by the highlighted green zone.

- Moving Averages:

- 10-day EMA (green): At ₹1,993.49, it closely follows the price, indicating short-term momentum remains bullish.

- 20-day EMA (orange): At ₹1,907.22, this moving average also slopes upward, reinforcing the medium-term uptrend.

- 200-day EMA (pink): At ₹1,430.75, the price is significantly above this level, confirming the stock is in a long-term uptrend.

- Volume:

- Volume spikes are seen during upward price movements, suggesting strong buying interest.

- Recent volumes are lower compared to earlier periods, indicating some consolidation near the resistance zone.

- RS Rating:

- The RS (Relative Strength) indicator at 80.13 highlights the stock’s strong performance compared to the broader market.

- Readings above 70 suggest significant strength, reinforcing bullish sentiment.

Technical Levels

- Resistance: ₹2,100 (highlighted zone) – The stock must break this level decisively to continue its rally.

- Support Levels:

- ₹1,993 (10-day EMA) – Acts as immediate support.

- ₹1,907 (20-day EMA) – Strong support for short-term corrections.

- ₹1,800 – Psychological support.

Indicators and Patterns

- Trend Continuation:

- The series of higher highs and higher lows indicates sustained bullish momentum.

- If the stock breaks the ₹2,100 resistance on strong volume, it could trigger another leg up.

- Volume Divergence:

- While price is testing resistance, declining volumes suggest buyers may hesitate. A breakout requires strong volume confirmation.

- RSI Perspective:

- With RS levels near 80, the stock may enter an overbought zone, increasing the likelihood of a consolidation or minor pullback before a breakout.

Potential Scenarios

- Bullish Breakout:

- If the price closes above ₹2,100 on strong volumes, it may target ₹2,200–₹2,300 in the near term.

- Traders can consider adding positions after confirmation of the breakout.

- Consolidation:

- If resistance at ₹2,100 holds, the stock may consolidate between ₹1,993 and ₹2,100.

- This phase can provide an opportunity for re-accumulation.

- Pullback:

- A break below ₹1,993 could lead to a short-term pullback toward ₹1,907 or even ₹1,800, offering long-term investors a better entry point.

Strengths and Opportunities

- High Market Share: Dominance in key pharmaceutical molecules, with a 50%-90% market share globally.

- Diversification: Expansion into specialty chemicals and battery materials reduces dependence on pharmaceuticals.

- R&D Investment: With a 23,681 sq. ft. DSIR-approved facility and patents in advanced synthesis processes, the company is well-positioned to innovate.

- Global Reach: Presence in 55 countries and strong client relationships with companies like Sun Pharma, Cipla, Bayer, and Himalaya.

Challenges

- High Valuation: With a PE ratio of 90.7, the stock trades at a premium, reflecting high growth expectations.

- Promoter Stake Reduction: Promoter holding has decreased by 5.08% over the last three years, raising questions about long-term commitment.

- Competition: Faces stiff competition from domestic and global players like Divi’s Labs and Neuland Labs.

Read Also : Understanding Amber’s Financials: A Stock Worth Watching?

Peer Comparison

| Company | CMP (₹) | P/E | Market Cap (₹ Cr) | ROCE (%) | Promoter Holding (%) |

|---|---|---|---|---|---|

| Divi’s Labs | 5,766 | 83.46 | 1,53,240 | 16.48 | 51.89 |

| Neuland Labs | 14,965 | 72.90 | 19,253 | 33.26 | 32.64 |

| Jubilant Pharmova | 1,145 | 64.21 | 18,274 | 6.74 | 50.68 |

| Ami Organics | 2,068 | 90.69 | 8,470 | 15.99 | 35.97 |

While Ami Organics has a higher PE ratio, its growth trajectory justifies this premium valuation to an extent.

Future Prospects

- Battery Revolution

The foray into battery electrolytes positions Ami Organics to benefit from the global EV boom and energy storage demands. - Rising Exports

Increasing export share and expansion into newer geographies offer immense growth potential. - Pharma and Agrochemical Growth

With growing global healthcare and agricultural demands, the company’s established presence in pharmaceutical intermediates and agrochemicals will be a significant growth driver.

Conclusion

Ami Organics Ltd is emerging as a compelling investment opportunity, driven by strong financial growth and robust technical performance. The company’s increasing revenue and profitability highlight its growing presence in the specialty chemicals sector, while its focus on high-margin advanced pharmaceutical intermediates and life sciences-related chemicals positions it for sustained growth. With expanding global demand and a competitive edge in R&D, the company is well-poised for long-term success.

From a technical perspective, Ami Organics is in a strong uptrend, trading significantly above its key moving averages. The stock is currently testing a crucial resistance at ₹2,100, with bullish momentum supported by rising relative strength (RS) and positive price action. A decisive breakout above this level, confirmed by strong volumes, could propel the stock toward ₹2,200–₹2,300 in the near term. Conversely, if resistance holds, the stock may consolidate or experience a short-term pullback, providing re-accumulation opportunities for investors.

Key Takeaway: With a solid financial foundation and bullish technical indicators, Ami Organics Ltd offers a promising mix of growth potential and market momentum. Investors should monitor key resistance and support levels while keeping an eye on volume patterns for signs of the next move. Both long-term investors and short-term traders stand to benefit from this dynamic growth story.