The Anup Engineering Limited, a renowned player in India’s engineering sector, has carved out a significant position in the market for industrial equipment. Established as a standalone entity following its demerger from Arvind Limited in 2018, Anup Engineering has since made remarkable strides in the manufacturing of specialized equipment for various industries. This blog delves into the company’s background, product portfolio, recent performance, capacity expansion, and future growth plans.

Table of Contents

Company Overview

After separating from its holding company, Arvind Limited, The Anup Engineering Limited emerged as a prominent manufacturer of industrial equipment. The company primarily produces heat exchangers, reactors, pressure vessels, columns and towers, centrifuges, and formed components. Its product lineup caters to a broad spectrum of industries, including oil and gas, petrochemicals, LNG, fertilizers, chemicals, pharmaceuticals, power generation, water treatment, pulp and paper, and aerospace.

Product Portfolio

Anup Engineering has a diverse range of products, which includes:

- Heat Exchangers: Specializes in shell and tube heat exchangers, including variations like helical baffle exchangers.

- Columns and Towers: Offers packed and tray columns for distillation processes in chemical and petrochemical plants.

- Reactors and Pressure Vessels: Capable of manufacturing high-thickness pressure vessels, with thicknesses of up to 180mm.

- Centrifuges: Supplies centrifuges primarily for the starch and chemical industries.

- Other Equipment: Includes formed components, which are vital for various industrial applications.

This comprehensive product range allows the company to serve multiple segments within the process industry, ensuring steady demand for its products.

Recent Performance and Financial Highlights

As of October 14, 2024, The Anup Engineering Limited is trading at ₹2,734 per share, with a market capitalization of ₹5,468 crores. The company boasts a healthy financial profile, marked by:

- Stock P/E Ratio: 50.3, reflecting the market’s optimism about its future growth.

- Return on Capital Employed (ROCE): 22.6%, indicating efficient use of capital.

- Return on Equity (ROE): 20.7%, showcasing its ability to generate profit from shareholders’ equity.

- Dividend Yield: 0.55%, with a consistent dividend payout ratio of 20.2%.

Over the past five years, Anup Engineering has shown an impressive compounded annual growth rate (CAGR) in profit of 18.9%, supported by an improvement in operational efficiency. The company’s working capital requirements have significantly reduced from 109 days to 62.8 days, while debtor days have improved from 125 to 84.4 days, underscoring a robust financial management strategy.

Geographical Presence and Clientele

In FY23, Anup Engineering’s revenue distribution was 81% from the domestic market and 19% from exports, reflecting a strong presence in India while steadily expanding its international reach. The company’s clientele includes major players in the engineering and industrial sectors, such as L&T Heavy Engineering, Indian Oil, Reliance, KNPC, TOYO, and GNFC. This diverse customer base further solidifies its reputation as a trusted supplier in the industry.

Order Book and Revenue Distribution

As of the most recent reports, Anup Engineering holds an order book of ₹530 crores, with the breakdown as follows:

- Heat Exchangers: 65%

- Pressure Vessels: 17%

- Towers and Reactors: 17%

- Centrifuges and Others: 2%

This distribution showcases the company’s significant expertise in heat exchangers and pressure-related equipment, which are essential components in the oil and gas and petrochemical industries.

Capacity Expansion and Ongoing Capex

To meet growing demand, Anup Engineering has undertaken substantial capacity expansions. In FY23, the company completed the Phase-I development of a new facility at Kheda, which is already operational. For FY24, it has earmarked ₹120 crores for the Phase-II expansion at the Kheda facility, with ₹80 crores likely to come from internal accruals. The investment is expected to further enhance production capacity and drive growth in the coming years.

Recent Financial Trends

The company’s financials have shown a positive trend over the past several years:

- Revenue Growth: From ₹243 crores in FY19 to ₹550 crores in FY24, showing steady growth.

- Operating Profit Margin (OPM): Stabilized at around 23%, with efforts to improve cost management.

- Net Profit Growth: The profit jumped significantly, reaching ₹109 crores in FY24, almost doubling from ₹51 crores in FY23.

- Earnings Per Share (EPS): Improved to ₹54.76 in FY24, driven by revenue growth and better cost control.

Trend Analysis

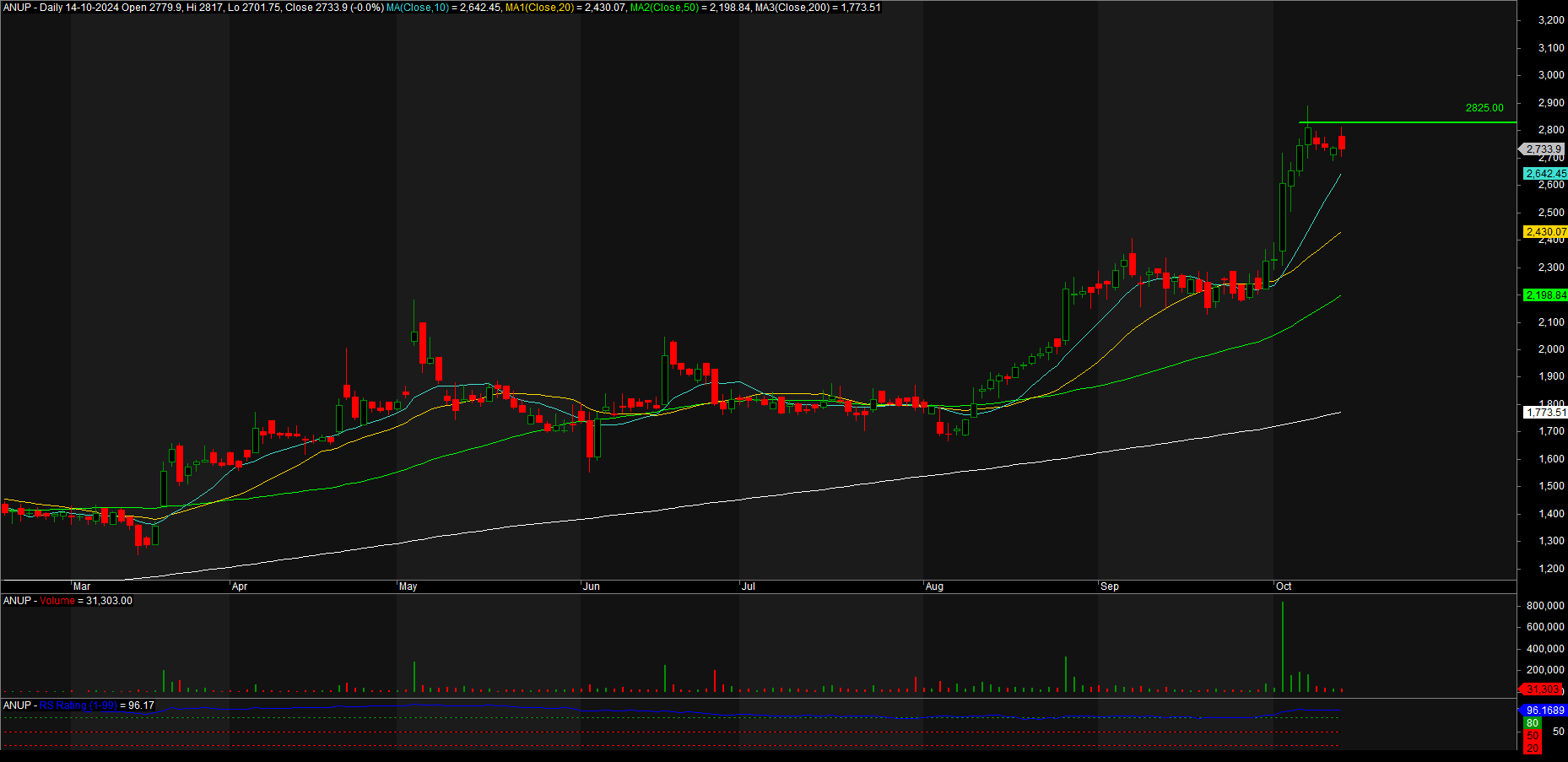

- Overall Trend: The stock shows an uptrend since mid-August, with a significant upward momentum. The price is trading above key moving averages (10-day, 20-day, 50-day, and 200-day), indicating a strong bullish trend.

- Moving Averages:

- 10-day Moving Average (MA): The stock is trading near the 10-day MA, suggesting near-term consolidation.

- 20-day Moving Average (MA): Positioned below the current price, providing additional support.

- 50-day Moving Average (MA): Below the 20-day MA, indicating a solid intermediate-term trend.

- 200-day Moving Average (MA): Far below the current price, confirming a long-term uptrend.

Support and Resistance Levels

- Immediate Resistance: The level at ₹2,825 appears to be a strong resistance point, where the stock has encountered selling pressure.

- Support Levels:

- Primary Support: The 10-day MA around ₹2,264 could act as a near-term support.

- Secondary Support: The 50-day MA around ₹1,944 offers more substantial support if the price drops significantly.

- Long-term Support: The 200-day MA at approximately ₹1,663 should provide strong long-term support.

Volume Analysis

- Volume Trends: The recent price rise is accompanied by increased volume, which indicates that the upward movement has buying support. However, the volume appears lower on recent down days, suggesting less aggressive selling.

Relative Strength (RS)

- RS Rating of 96: Indicates that the stock is outperforming a significant percentage of the market. This rating suggests relative strength in the ongoing trend.

Amalgamation for Strategic Realignment

In a significant corporate move, Anup Engineering’s board has approved the amalgamation between Anup Heavy Engineering Ltd and Anup Engineering India Ltd, subject to regulatory approvals. The company anticipates completing the amalgamation by FY24. This merger is expected to create a more streamlined organizational structure and help capitalize on synergies within the business.

Read Also : V-Mart on the Verge of a Breakout

Key Pros and Cons

Pros:

- The company has successfully reduced debt and is almost debt-free.

- It has delivered a robust profit growth of 18.9% CAGR over the last five years.

- It maintains a healthy dividend payout, contributing to shareholder returns.

- Improved operational metrics, with reduced debtor and working capital days.

Cons:

- The stock is trading at 10.3 times its book value, which may indicate high valuation.

- There has been a slight reduction in promoter holding over the last quarter.

- The company has a relatively low tax rate, which could be a risk if there are tax law changes.

Comparative Analysis

When compared to its peers in the engineering industry, such as Tega Industries, Azad Engineering, Skipper, and others, Anup Engineering holds a competitive edge in terms of profitability and operational efficiency:

- It has a relatively high ROCE (22.6%) compared to the sector’s median.

- Its debt-free status is a significant advantage over some competitors with higher borrowing levels.

Conclusion

The Anup Engineering Limited stands out as a well-positioned company in the Indian engineering sector, with a strong product portfolio, a diversified clientele, and an expanding market presence. With its ongoing capacity expansion, strategic amalgamation, and sound financial management, the company is poised for continued growth. However, potential investors should keep an eye on valuation metrics and any changes in promoter holdings.

The technical outlook for Anup Engineering is positive, with strong support from various moving averages and a bullish trend. A breakout above ₹2,825 could signal a continuation of the uptrend, while a pullback to the 10-day or 50-day MA could provide buying opportunities. Caution is advised if the price breaks below the 200-day MA, as it could indicate a potential reversal in the long-term trend.

Anup Engineering’s journey from a subsidiary to a standalone industry leader is a testament to its growth potential in a dynamic market. As it continues to expand its footprint both domestically and internationally, the company is set to leverage its expertise and infrastructure to drive future success.