Arihant Capital: A Comprehensive Overview of Growth and Excellence

Arihant Capital Markets Limited (ACML) has established itself as one of India’s premier financial services companies, offering a diverse range of services including stock and commodity broking, portfolio management services (PMS), merchant banking, insurance broking, real estate, and more. Since its incorporation in 1992, ACML has been a trusted partner to retail investors, high-net-worth individuals (HNWIs), mutual funds, financial institutions, and corporate clients. Over the years, the company has consistently evolved to meet the needs of its clients while maintaining a strong focus on profitability, growth, and innovation.

Key Financial Highlights (FY 2023-2024)

ACML achieved a remarkable financial performance in the fiscal year 2023-2024, with significant growth across all key metrics:

- Total Revenue: ₹236 crore, marking a 71% year-on-year (YoY) growth.

- Operating Profit: Crossed the ₹100 crore mark, reaching ₹105 crore.

- Net Profit: ₹70.51 crore, up by an impressive 142% YoY.

- Dividend Distribution: ACML declared a 50% dividend for the year, maintaining its 17-year streak of consistent dividend payouts.

These figures reflect ACML’s robust business model, efficient operations, and strategic initiatives that have fueled its growth despite a challenging macroeconomic environment.

Diverse Revenue Streams

ACML derives its income from multiple sources, showcasing its diversified approach:

- Brokerage Income: The largest revenue generator, contributing ₹10,765.70 lakh for FY 2023-2024, up from ₹7,148.87 lakh in the previous year.

- Interest Income: Primarily from margin funding and delayed client payments, accounting for ₹6,361.16 lakh in FY 2023-2024.

- Fees and Commission Income: Including subscription-based services and distribution of financial products, totaling ₹396.77 lakh.

This diversity in income streams helps ACML maintain a steady cash flow and manage risks, ensuring long-term sustainability.

Innovative Trading Platform: ArihantPlus

Arihant Capital’s commitment to innovation is evident in the development of its trading platform, ArihantPlus. This cutting-edge platform is designed to empower investors by offering seamless trading experiences, backed by real-time market data, advanced research, and intuitive tools. ArihantPlus is part of the company’s broader fintech strategy, which aims to make investment accessible to every Indian through the strategic use of technology.

Strategic Growth Amid Economic Challenges

Despite the global uncertainties marked by inflation, geopolitical tensions, and market volatility, ACML has managed to stay on course, maintaining long-term optimism in the Indian market. The company attributes its success to several factors:

- Robust Business Model: The ability to offer a wide array of financial services allows ACML to capture various segments of the market.

- Focus on Technology: ACML continues to innovate through its fintech initiatives, positioning itself as a leader in the Indian financial landscape.

- Commitment to Client Success: By offering personalized investment solutions and advanced tools, ACML ensures that its clients can make informed decisions to achieve their financial goals.

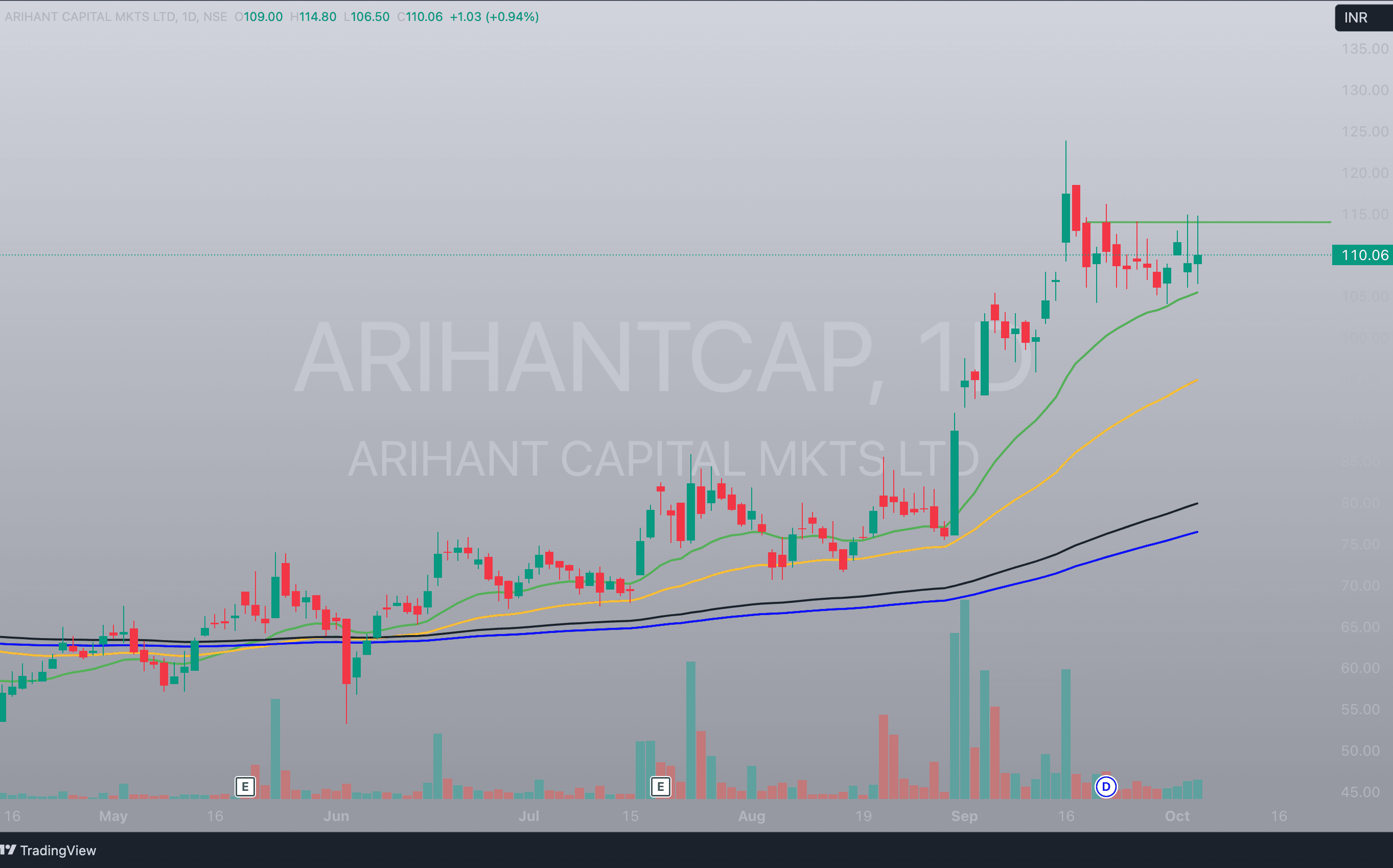

Technical Analysis: Arihant Capital Stock Performance

As of October 4, 2024, Arihant Capital Markets Ltd.’s stock price stands at ₹110, showing a 0.94% change on the day. Below is a technical analysis of the stock’s performance over recent months:

- Price Trend: The stock has been on a steady upward trend since early 2024, rising from ₹48.9 (52-week low) to ₹110, with a 52-week high of ₹124.

- Moving Averages: Both the 50-day and 200-day moving averages indicate a strong bullish momentum. The stock price has been consistently above the 200-day MA, a signal of long-term positive sentiment.

- Volume Analysis: A noticeable uptick in trading volume over the last few months suggests heightened investor interest. This surge in volume is often indicative of strong institutional buying.

- Resistance and Support Levels: The stock has tested and broken through key resistance levels at ₹100 and ₹105. The next potential resistance is at ₹115, while ₹105 now serves as a strong support level.

Leadership and Vision

Under the leadership of Ashok Kumar Jain (Managing Director) and Arpit Jain (Joint Managing Director), ACML has demonstrated a clear vision of empowering investors while maintaining ethical business practices. Their commitment to shareholder value is reflected in the company’s consistent dividend payouts and strategic initiatives aimed at ensuring sustained profitability.

Sustainability and Corporate Responsibility

ACML also places a strong emphasis on corporate governance, sustainability, and social responsibility. The company is not only committed to delivering financial returns but also to contributing to the broader community through initiatives focused on financial literacy and empowerment.

The Future of Arihant Capital

Looking ahead, ACML is poised for continued growth. With India’s economic fundamentals remaining strong, the company aims to further expand its client base, enhance its technological capabilities, and strengthen its position as a leading player in the financial services sector. Key areas of focus for the future include:

- Enhanced Digital Offerings: Through platforms like ArihantPlus, ACML plans to offer more personalized and data-driven services to its clients.

- Expansion into New Markets: As the Indian economy grows, ACML is well-positioned to tap into new segments, including younger investors and rural markets.

- Sustainable Growth: ACML’s management is committed to sustainable, long-term growth by balancing profitability with responsible business practices.

Conclusion

Arihant Capital Markets Ltd. has carved a niche for itself in India’s financial services landscape by offering a diversified portfolio of services and consistently delivering value to its shareholders. Its focus on technology, innovation, and customer-centric solutions ensures that the company remains at the forefront of the industry, ready to capitalize on the opportunities presented by India’s evolving financial ecosystem.

As ACML looks to the future, its strong financial foundation, leadership team, and commitment to innovation make it a company to watch in the coming years. With continued focus on growth, sustainability, and client success, Arihant Capital is well-positioned to remain a leader in India’s dynamic financial market.