Banco Products India Limited, popularly known as Banco India, is a leading player in the auto component industry. The company specializes in manufacturing engine cooling modules and other thermal systems for automobiles and industrial applications. With a strong domestic presence and an expanding global footprint, Banco India is recognized for its robust fundamentals and innovative product offerings.

Table of Contents

Company Overview

Founded in 1961, Banco India has grown to become a trusted name in the automotive and industrial segments. The company’s product portfolio includes radiators, gaskets, and other engine cooling solutions that cater to a wide range of clients, including original equipment manufacturers (OEMs) and the aftermarket.

Banco India has consistently focused on quality and innovation. The company’s manufacturing facilities are equipped with state-of-the-art technology, ensuring that its products meet international standards. Banco India also invests heavily in research and development, which has helped the company maintain a competitive edge in the market.

Financially, Banco India has demonstrated steady growth. Over the years, the company has reported increasing sales and profitability. Its efficient cost management and a diversified client base contribute to its strong financial health. In recent quarters, the company’s revenue and net profit margins have improved, reflecting strong operational performance.

Recent Developments

Banco India has been in the spotlight recently due to its impressive stock performance. Over the past few months, the stock has experienced a significant rally, driven by strong quarterly results and positive market sentiment. The company’s focus on expanding its global presence and diversifying its product portfolio has further boosted investor confidence.

Additionally, Banco India’s commitment to sustainability and green initiatives has resonated well with investors. The company has been actively working on reducing its carbon footprint and adopting environmentally friendly practices in its operations.

Technical Analysis

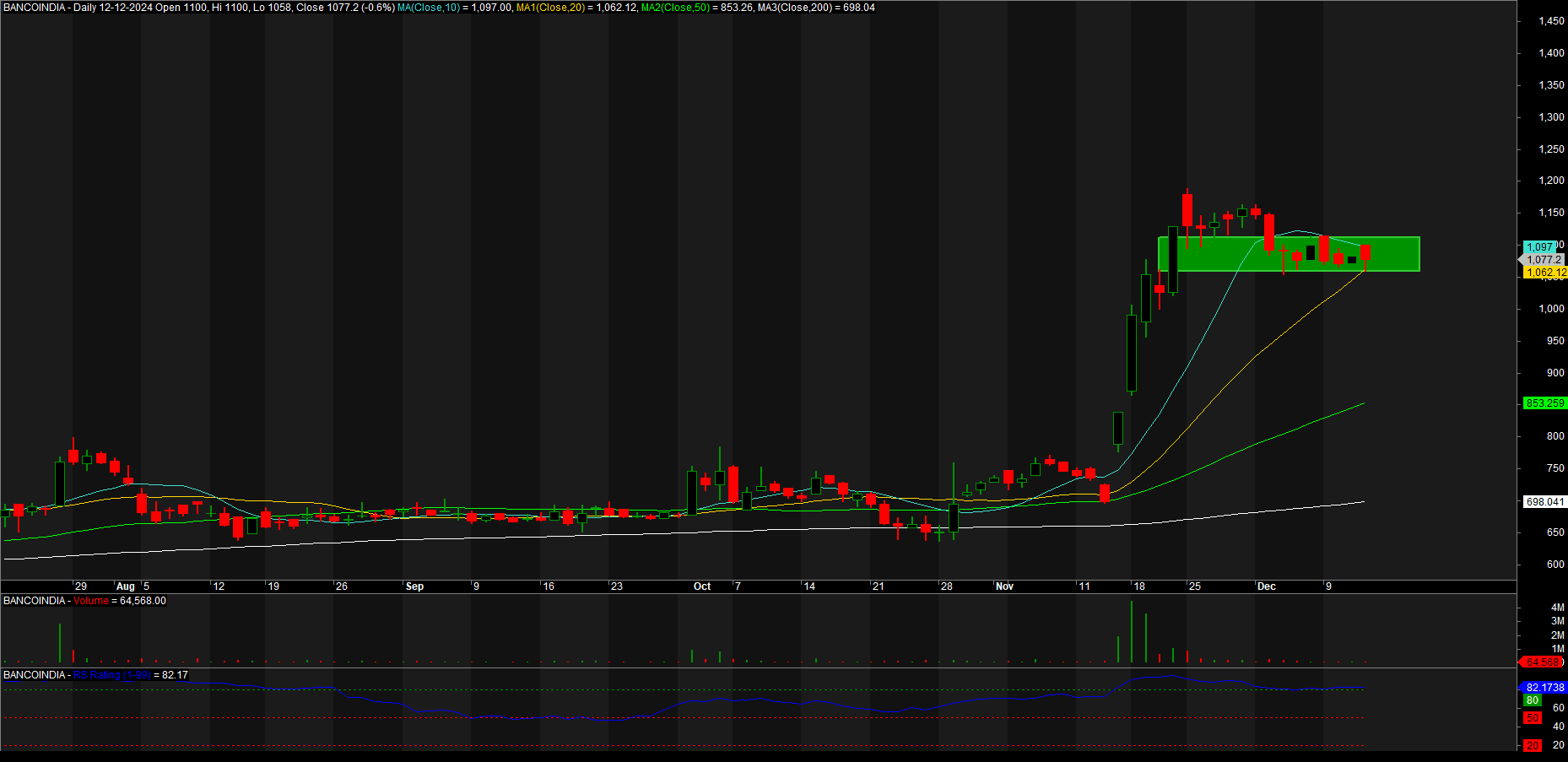

BANCO INDIA chart in Daily time frame

The stock chart provided indicates that Banco India has recently experienced a sharp upward movement, reaching new highs before consolidating in a tight range. Let’s delve into the technical aspects:

- Moving Averages:

- The 10-day moving average (MA) is currently at 1,097, while the 20-day moving average is at 1,062. Both are trending upward, suggesting a bullish momentum in the short to medium term.

- The 50-day moving average at 853 and the 200-day moving average at 698 indicate a strong uptrend in the longer term.

- Support and Resistance Levels:

- The green box on the chart highlights a consolidation zone between 1,050 and 1,100. This range acts as a strong support level, indicating that the stock is currently building a base for its next move.

- On the upside, resistance can be expected near the recent high of 1,200.

- Volume Analysis:

- The recent rally was accompanied by high trading volumes, which is a positive sign. However, the volume has tapered off during the consolidation phase, suggesting that sellers are not dominating.

- Relative Strength Index (RSI):

- The RSI is currently at 82, indicating overbought conditions. While this signals caution, it also reflects strong buying interest in the stock.

When to Buy

Investors looking to enter Banco India should consider the following scenarios:

- Consolidation Breakout: If the stock breaks above the 1,100–1,120 range with strong volume, it could signal the start of the next upward leg. This would be an ideal entry point for momentum traders.

- Pullback to Support: For long-term investors, a pullback to the support zone around 1,050–1,070 provides an attractive buying opportunity. Ensure that the stock holds this level before making a move.

Investment Rationale

Banco India’s strong fundamentals, coupled with its technical setup, make it a compelling investment option. The company’s consistent growth, focus on innovation, and commitment to sustainability position it well for future success. Moreover, the technical indicators suggest that the stock is in a healthy uptrend, making it suitable for both short-term and long-term investors.

Read Also : Vishal Mega Mart IPO: Unlocking the Potential of India’s Retail Giant

Risks to Consider

As with any investment, there are risks associated with Banco India. These include:

- Market Volatility: The stock’s recent rally may lead to profit-booking, causing short-term volatility.

- Economic Slowdown: Any downturn in the automotive or industrial sectors could impact the company’s revenue.

- Global Competition: As Banco India expands internationally, it may face challenges from established players in foreign markets.

Conclusion

Banco India is a promising investment opportunity for those looking to capitalize on the growth in the auto component industry. The company’s strong fundamentals, coupled with its bullish technical setup, make it a stock worth considering. Investors should monitor the stock’s price action closely and use the suggested entry points to optimize their returns.

By combining fundamental analysis with technical insights, investors can make informed decisions about when to buy Banco India and capitalize on its growth potential.