Kiri Industries Limited, a leading name in the dyestuff and chemicals industry, has been garnering attention for its strong business fundamentals and stellar stock performance. Known for its commitment to sustainability and innovation, Kiri Industries has established itself as a key player in both the domestic and global markets. In this blog, we will delve into the company’s background, recent developments, and perform an in-depth technical analysis based on the chart provided.

Table of Contents

Company Overview

Kiri Industries was founded with a focus on producing a wide range of dyestuffs, dye intermediates, and basic chemicals. Over the years, the company has expanded its operations, building a robust manufacturing and distribution network that caters to clients across multiple industries, including textiles, paper, and leather.

One of the company’s key strengths lies in its emphasis on research and development. By adopting cutting-edge technology and sustainable practices, Kiri Industries has managed to stay ahead of its competitors while meeting stringent environmental standards. This has helped the company maintain a strong foothold in the market, with an ever-growing client base that spans across the globe.

From a financial perspective, Kiri Industries has demonstrated resilience and consistent growth. The company’s revenue and profitability have shown an upward trend, supported by strong demand for its products and efficient cost management. With a diversified product portfolio and a focus on value-added services, Kiri Industries is well-positioned for long-term growth.

Recent Developments

The stock of Kiri Industries has been a top performer in recent months, attracting both retail and institutional investors. This surge can be attributed to multiple factors, including:

- Strong Quarterly Results: The company’s latest financial report revealed impressive growth in revenue and net profit, underscoring its operational efficiency.

- Global Expansion: Kiri Industries has been actively expanding its footprint in international markets, particularly in Asia and Europe, which has boosted investor confidence.

- Sustainability Initiatives: The company’s focus on green manufacturing processes has resonated with investors seeking ESG-compliant investment opportunities.

Technical Analysis

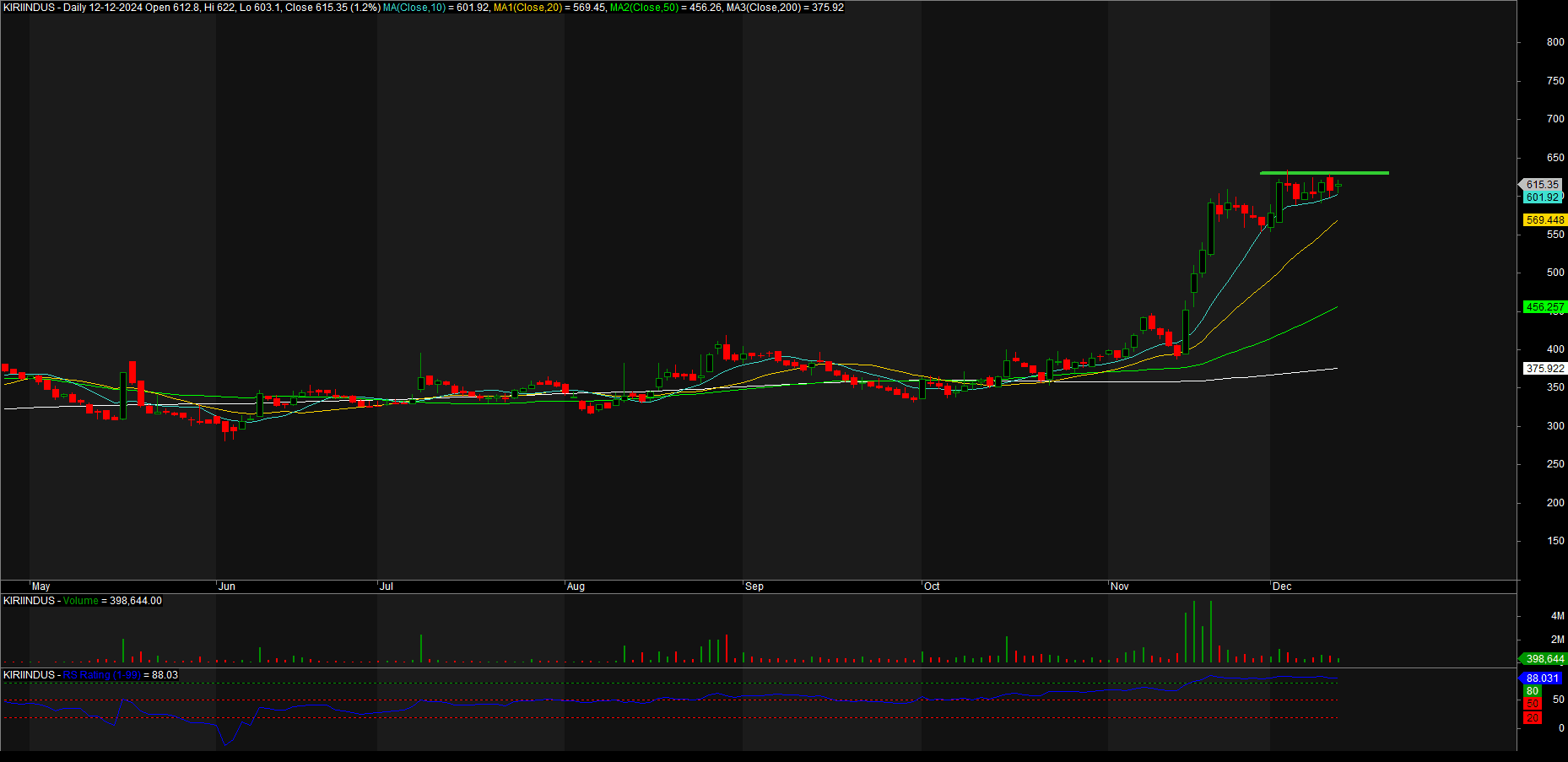

- Price Action and Moving Averages:

- The stock is currently trading at ₹615.35, showing a 1.2% gain for the day.

- The 10-day moving average (₹601.92) and the 20-day moving average (₹569.45) are both trending upward, confirming a short-term bullish trend.

- The 50-day moving average (₹456.26) and the 200-day moving average (₹375.92) are significantly lower, highlighting the strong momentum in the medium and long term.

- Consolidation and Resistance:

- The stock has been consolidating just below the ₹620 resistance level, as indicated by the green horizontal line on the chart. A breakout above this level could signal further upside potential.

- Key support levels can be identified around ₹600 and ₹580, which coincide with previous consolidation zones and moving average levels.

- Volume Analysis:

- Trading volumes have been robust during the recent rally, indicating strong buying interest. The slight decrease in volume during the consolidation phase suggests that sellers are not dominating, which is a positive sign.

- Relative Strength Index (RSI):

- The RSI is currently at 88.03, indicating overbought conditions. While this suggests caution in the short term, it also reflects the strong demand for the stock.

Investment Strategy

Investors looking to capitalize on Kiri Industries’ growth story can consider the following strategies:

- Breakout Trading: A breakout above ₹620 with high volume could present an ideal entry point for momentum traders.

- Pullback Buying: Long-term investors may wait for a pullback to the support zone around ₹600 before entering the stock. This approach minimizes risk while ensuring a favorable risk-reward ratio.

Read Also : Banco India: A Bullish Opportunity in the Auto Component Sector

Growth Potential and Risks

Kiri Industries’ strong fundamentals and technical setup make it an attractive investment option. However, potential investors should also consider the risks:

- Market Volatility: Short-term price fluctuations may occur, especially given the overbought RSI levels.

- Global Economic Conditions: Any slowdown in the global economy could impact demand for the company’s products.

- Regulatory Challenges: As an exporter of chemicals, Kiri Industries may face regulatory hurdles in international markets.

Conclusion

Kiri Industries is a compelling stock for investors seeking exposure to the chemicals sector. Its robust fundamentals, coupled with a strong technical setup, suggest that the stock is well-positioned for further growth. By keeping an eye on the key levels and indicators discussed, investors can make informed decisions and maximize their returns.

In conclusion, Kiri Industries exemplifies a blend of innovation, sustainability, and financial strength, making it a stock worth considering for both short-term gains and long-term value creation.