Piramal Pharma Ltd. (PPL), a prominent player in the pharmaceutical industry, is a subsidiary of the Piramal Group. Established in 1988, with the acquisition of Nicholas Laboratories, the company has since evolved through various mergers, acquisitions, and strategic developments. Today, PPL operates in three primary segments: Contract Development and Manufacturing Organizations (CDMO), Complex Hospital Generics (Critical Care), and Consumer Healthcare (OTC). The company continues to strengthen its global presence, innovation capabilities, and growth trajectory.

Key Business Segments and Growth Prospects

- Contract Development and Manufacturing Organizations (CDMO)

PPL’s CDMO division is a cornerstone of its business, operating across 13 manufacturing sites in North America, Europe, and India. As one of the top three CDMO players in India and ranked 13th globally, the company serves over 500 global customers. PPL’s CDMO business offers a broad range of services, including drug discovery, development, and commercial manufacturing, catering to innovators from the preclinical stage to commercialization.In Q3FY24, PPL secured its first integrated order for antibody-drug conjugates (ADC), reflecting its commitment to cutting-edge technologies. This high-value contract involved monoclonal antibodies, with manufacturing spread across three key sites: Lexington, Grangemouth, and Yapan. The CDMO division is expected to see continued growth, driven by increasing demand for contract manufacturing services in advanced pharmaceutical technologies. - Complex Hospital Generics (Critical Care)

The complex hospital generics segment plays a crucial role in providing life-saving drugs to hospitals globally. The demand for critical care products has grown significantly in recent years, positioning PPL to capitalize on this trend. The company’s expertise in developing complex hospital generics with specialized knowledge and high regulatory barriers ensures a competitive edge in this high-demand space. - Consumer Healthcare (OTC)

PPL’s OTC division offers a wide range of consumer healthcare products. This segment is expected to benefit from growing consumer awareness of preventive healthcare and wellness, which has been accelerated by the pandemic. PPL’s strong brand presence and expanding product portfolio are key drivers of growth in this segment.

Financial and Operational Performance of Piramal Pharma

Piramal Pharma Ltd.’s market performance reflects its solid position in the pharmaceutical sector. As of October 2023, PPL’s market capitalization is ₹30,390 crore, with a stock price of ₹229, marking a significant rise from its 52-week low of ₹87.5. Despite a high price-to-earnings (P/E) ratio of 755, indicative of future earnings growth, the company’s valuation suggests long-term investment potential, supported by its robust expansion strategies.

Key Financials:

- Market Cap: ₹30,390 Cr

- Stock Price (as of October 4, 2023): ₹229

- Book Value: ₹59.8

- Revenue (TTM): ₹8,373 Cr

- Net Profit: ₹28 Cr (TTM)

- Operating Profit Margin (TTM): 15%

- Return on Capital Employed (ROCE): 5.49%

- Return on Equity (ROE): 0.22%

While the company has faced profitability challenges in recent quarters, recent improvements in operating profit margins and cash flows from operations reflect a positive shift. PPL’s strategic focus on technological innovation and expanding CDMO capabilities signals potential for substantial earnings growth.

Peer Comparison

In comparison to its peers in the pharmaceutical sector, PPL is in a transition phase. While competitors such as Sun Pharma, Cipla, and Dr. Reddy’s boast stronger ROE and lower P/E ratios, PPL’s investments in its CDMO division and consumer healthcare portfolio position it for future growth. The chart below outlines key financial metrics of PPL versus its competitors.

| Company | CMP Rs. | P/E | Market Cap Rs.Cr. | ROCE % |

|---|---|---|---|---|

| Sun Pharma | 1910.05 | 43.46 | 458,284.98 | 17.32 |

| Cipla | 1623.30 | 29.57 | 131,092.35 | 22.80 |

| Dr. Reddy’s Labs | 6633.25 | 19.89 | 110,693.65 | 26.53 |

| Zydus Lifesciences | 1057.35 | 25.52 | 106,394.15 | 22.34 |

| Piramal Pharma | 229.23 | 755.03 | 30,390.12 | 5.49 |

PPL’s relatively high P/E ratio indicates expectations of high growth potential, as it ramps up operations in its core segments, particularly CDMO.

Growth Drivers and Future Plans

Several key drivers will contribute to Piramal Pharma’s future growth:

- Focus on Advanced Drug Development

The CDMO segment will be the primary driver of growth, especially with 46% of molecules in the CDMO pipeline currently in Phase 3 trials. This suggests significant future revenue as these drugs progress to commercial production. - Geographic Expansion

PPL is actively expanding its global footprint, particularly in North America and Europe, which are the largest markets for pharmaceutical development. The company’s integrated service offering from drug discovery to commercialization positions it as a preferred partner for biotech firms in these regions. - Investment in Cutting-edge Technologies

PPL’s investment in cutting-edge technologies, such as ADCs and monoclonal antibodies, strengthens its competitive position in complex hospital generics. The company’s fully integrated CDMO services give it an edge in handling complex pharmaceutical development processes. - Inorganic Growth Through Acquisitions

PPL has a strong history of growth through acquisitions, which is likely to continue as the company seeks to expand its product portfolio and capabilities. Recent acquisitions have already positioned PPL as a leader in the global pharmaceutical space.

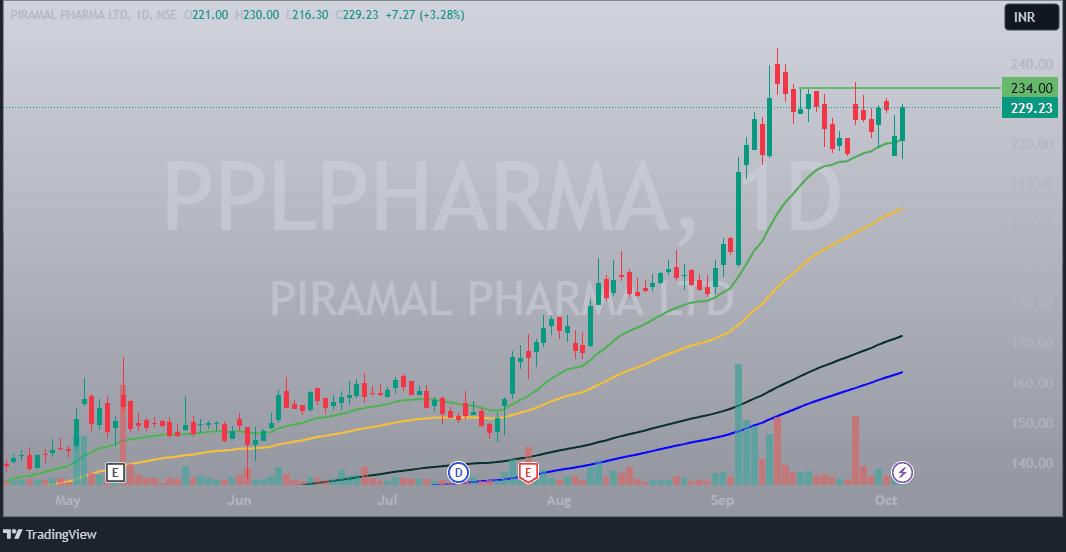

Daily Chart of Piramal Pharma

Technical Analysis: Chart Insights

The technical chart analysis for Piramal Pharma Ltd. reveals key trends and market signals that reflect the company’s stock movement:

- Support Levels: PPL recently saw strong support around ₹87.5, its 52-week low, with significant buying interest near these levels. This suggests that investors view this price range as an attractive entry point.

- Resistance Levels: The stock is currently trading at ₹229, showing resistance near ₹234 levels. A breakout above this level could signal further upward momentum.

- Volume Trends: The increase in trading volumes over the last few months indicates rising investor interest in PPL, as the company’s earnings and business expansion strategies begin to take shape.

- Moving Averages: The stock is trading above its 50-day and 200-day moving averages, which signals a bullish trend in the short to medium term. The convergence of moving averages suggests potential upside momentum if the company continues to execute on its strategic plans.

Read Also: Ram Ratna Wires Ltd: The Hidden Gem Poised for Explosive Growth!

Challenges and Conclusion

PPL’s high P/E ratio and low ROE of 0.22% present some challenges, indicating potential overvaluation in the near term. However, with the company’s strategic focus on expanding CDMO capabilities, advancing OTC products, and investing in advanced technologies, it is well-positioned for long-term growth. The company’s global expansion efforts and strong order pipeline further enhance its growth potential.

In conclusion, Piramal Pharma Ltd. is a company poised for significant future growth, driven by its expanding presence in the global pharmaceutical landscape and its investments in innovation. Investors should monitor the stock closely for potential breakouts, as Piramal Pharma’s long-term growth trajectory could translate into substantial returns in the coming years.