As India’s infrastructure sector continues to expand, Power Mech Projects Ltd (PMPL) stands out as a formidable force in the engineering and construction space. Incorporated in 1999, the company has steadily risen to prominence, providing integrated services across a wide spectrum of infrastructure projects. From ultra mega power projects to critical operations and maintenance services, Power Mech’s comprehensive offerings make it a key player in India’s industrial growth story.

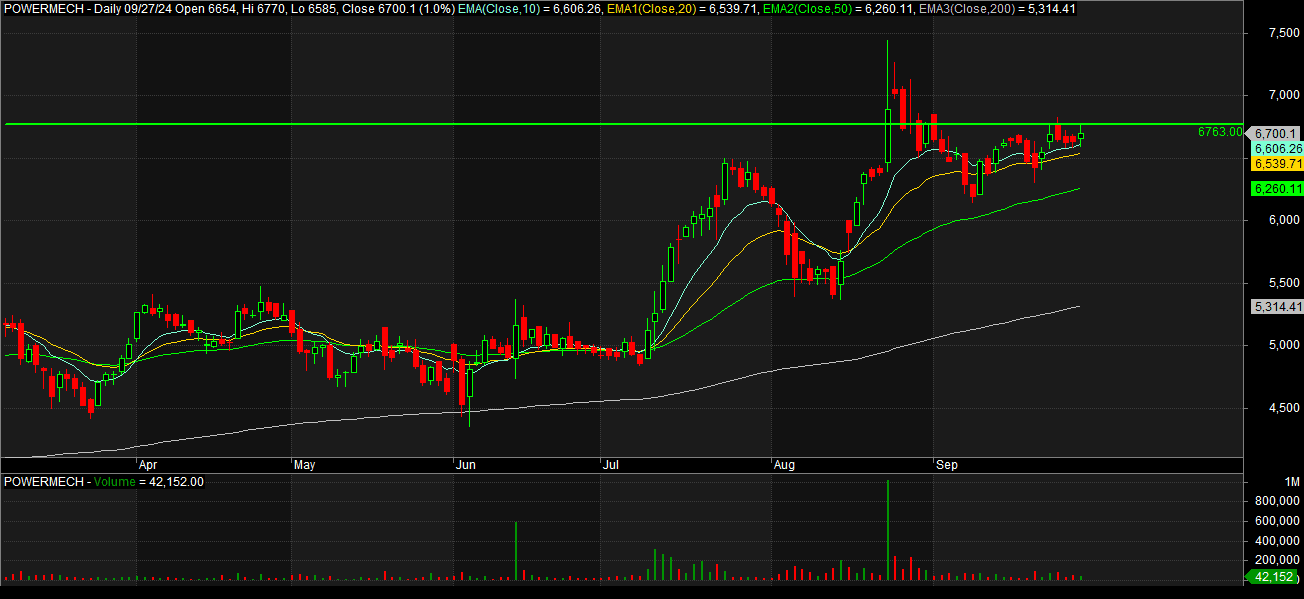

Daily Chart of POWER MECH

Technical Analysis of Power Mech Projects Ltd.

- Price Action:

- The stock closed at 6,700.1 on September 27, 2024, with an increase of 1.0% for the day.

- The stock is currently consolidating near the 6,700 level after a sharp rally in August. There is resistance near the 6,763 level, as indicated by the green horizontal line.

- Exponential Moving Averages (EMAs):

- EMA(10) – 6,606.26: This short-term EMA is slightly below the current price, indicating recent bullish strength.

- EMA(20) – 6,539.71: Also below the current price, further confirming a bullish trend.

- EMA(50) – 6,260.11: The medium-term EMA has provided support during price dips, indicating that the stock is maintaining strength over the medium term.

- EMA(200) – 5,314.41: This long-term EMA is far below the current price, suggesting the stock is in a long-term uptrend.

- Volume:

- Volume is at 42,152 for this session, which appears to be below the average volume. This might indicate weaker conviction behind the current price movement or consolidation.

- Support and Resistance:

- Resistance: The 6,763 level is a key resistance level. The stock has tested this level multiple times but has not been able to break above it decisively.

- Support: The 6,260 level is acting as support, indicated by the green EMA(50). If the price drops below this, the next key support is near 5,314 (EMA 200).

- Trend:

- The overall trend since July has been bullish, as seen by the upward movement in price and the EMAs sloping upwards.

- The current consolidation suggests the stock is taking a breather after its sharp move in August. A breakout above 6,763 would indicate further bullishness.

The Business at a Glance

Power Mech Projects Ltd operates through five strategic business units:

- Industrial Services: A wide range of erection, testing, and commissioning services for industrial plants.

- Industrial Construction: This division handles large-scale construction projects, contributing significantly to India’s industrial infrastructure.

- Infrastructure Construction: Focuses on highways, railways, and other critical infrastructure.

- Manufacturing & Heavy Fabrication: Providing specialized manufacturing solutions and heavy fabrication services.

- Mining: Expanding into mining, a critical sector that is poised for growth in the coming years.

These units not only highlight the company’s diversity but also its resilience in handling projects across sectors. Whether it’s power generation or heavy engineering, Power Mech Projects has established itself as a go-to service provider for some of the most complex projects in India.

Financial Overview

The company’s financial performance reflects its robust business model. As of October 1, 2024, Power Mech’s stock price stands at ₹6,721, with a market capitalization of ₹10,625 Crores. Over the last year, the stock has surged, reaching a 52-week high of ₹7,450, indicating strong investor confidence.

Power Mech’s key financial ratios are noteworthy:

- P/E Ratio: 41.3, suggesting the market sees growth potential in the company.

- ROCE (Return on Capital Employed): 23.8%, which reflects the efficiency with which the company is generating profit from its capital.

- ROE (Return on Equity): 15.9%, highlighting a strong return on shareholder investments.

- Dividend Yield: While the dividend yield is relatively low at 0.01%, this is indicative of Power Mech’s strategy of reinvesting profits to fuel future growth rather than focusing on shareholder payouts.

Recent Financial Performance

The company’s quarterly results for June 2024 paint a picture of solid operational performance:

- Sales: ₹1,007 Crores

- Operating Profit Margin: 11%

- Net Profit: ₹62 Crores

- EPS: ₹38.04

- Company has received an order worth of ₹ 226.66 Crores (excluding GST) related to Comprehensive Operations and Maintenance (O&M) partner for Gujarat Mineral Development Corporation Limited’s 250 (2X125) MW Akrimota Thermal Power Station (ATPS), Gujarat.

Notably, Power Mech’s operating profit margin has been consistent at around 11% over the past year, showing its ability to maintain profitability even amid increasing expenses and market fluctuations.

Strategic Growth and Challenges

Power Mech Projects Ltd has seen significant growth in its core business areas:

- 3-Year Sales Growth: 31%

- 3-Year Profit Growth: 95%

This growth is primarily driven by Power Mech’s ability to secure large-scale contracts in the power and infrastructure sectors. Its involvement in ultra mega power projects and super-critical thermal power projects has bolstered its revenue stream and added to its reputation as a reliable EPC (Engineering, Procurement, and Construction) provider.

However, challenges remain. The promoter holding has decreased slightly in the last quarter by 2.09%, raising questions about insider confidence. Additionally, like most infrastructure companies, Power Mech is exposed to risks related to project delays, regulatory challenges, and the high capital intensity of its projects. Despite these challenges, the company’s zero pledged share percentage reflects its strong financial health and management confidence.

Peer Comparison

In the infrastructure and engineering sector, Power Mech competes with giants like Larsen & Toubro (L&T), Techno Electric Engineering, and Engineers India. Here’s how Power Mech stands among its peers:

- Larsen & Toubro: At a much larger market cap of ₹5,02,354 Crores, L&T is a diversified behemoth in infrastructure, but Power Mech’s 41.3 P/E ratio is close to L&T’s 37.8, suggesting both companies are seen as strong growth bets.

- Techno Electric Engineering: With a P/E ratio of 61.76, Techno Electric may be priced higher in the market, but Power Mech’s robust sales and profit growth figures demonstrate it is a strong competitor in this niche market.

Future Outlook

As India pushes forward with infrastructure development, Power Mech Projects Ltd is positioned to benefit from various government initiatives and private-sector investments in sectors like power, manufacturing, and heavy engineering. The company’s diverse portfolio and strategic business units make it resilient to market fluctuations.

With infrastructure projects becoming more complex and the demand for efficient power generation solutions growing, Power Mech Projects Ltd has the potential to ride this wave of growth. The company’s commitment to expanding its business beyond traditional power projects into areas like mining and heavy fabrication ensures that it remains competitive in the long term.

Entry Point

- The stock is in a consolidation phase, with immediate resistance at 6,763 and strong support at 6,260.

- A breakout above the resistance level could lead to further upward momentum, while a breakdown below support might suggest a potential reversal or deeper pullback.

Final Thoughts

Power Mech Projects Ltd represents a compelling growth story in India’s infrastructure sector. Its steady financials, strategic diversification, and growing presence across industrial sectors make it a stock to watch for investors looking for exposure to India’s infrastructure boom.

With consistent profitability and a clear focus on expansion, Power Mech Projects Ltd is set to continue its upward trajectory, making it a crucial player in shaping India’s industrial and infrastructure landscape.

Disclaimer: The information presented in this blog is for informational purposes only. It should not be construed as investment advice. Investors are advised to conduct their own research before making any investment decisions.

Also Read : Ram Ratna Wires Ltd: The Hidden Gem Poised for Explosive Growth!