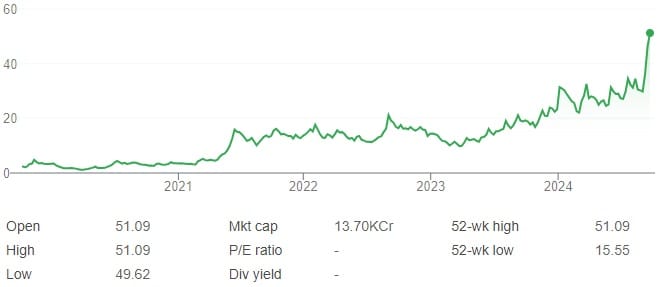

Reliance Power (RPower) has seen an impressive rally in 2024, with its stock rising over 100% this year, reaching a fresh 52-week high. This surge has been part of a broader rally in power sector stocks. Despite this, some technical indicators are showing caution signs.

Analysts point to the formation of a bearish pattern (Evening Star Candlestick) and a break below its upward trend channel. This suggests that the stock may face a correction soon. Additionally, the Relative Strength Index (RSI) has exited the overbought zone, further signaling a possible weakening momentum. Some projections indicate the stock could fall to levels of ₹21.50–₹20.50 in the short term(Stock Price Archive)(ET NOW).

Given these factors, it could be a good time to assess your position based on your risk appetite and investment goals. While the stock has delivered strong returns, including a 504% gain over three years, it has also been volatile, erasing 65% of investors’ wealth over the last decade

Exiting could be prudent if you’re looking to lock in profits, but holding might offer more long-term potential if you’re optimistic about the company’s future growth, particularly as the power sector evolves.