Amber Enterprises India Ltd., founded in 1956, is a prominent player in the Indian air conditioning industry, specifically serving as a leading provider for Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) solutions. With a 23.6% market share in the Room Air Conditioner (RAC) sector, Amber plays a crucial role in supplying essential components and fully-assembled units to renowned consumer electronics brands such as LG, Daikin, Hitachi, and others. Over the years, Amber has diversified its product offerings and expanded its operations, making it a key player in the consumer durables and electronics sectors in India.

Amber Enterprises is strategically positioned in the RAC industry and other consumer durables, catering to both domestic and international clients. The company has maintained a steady growth trajectory, supported by a strong product portfolio, expansive manufacturing capabilities, and a focus on technological advancement.

Product Portfolio and Business Segments

Amber’s product line is comprehensive and diverse, covering everything from complete RAC units to non-air conditioning components. Here’s an overview of its core business segments:

- Room Air Conditioners (RAC):

- Amber manufactures complete RAC units, including Window Air Conditioners and indoor/outdoor split units with varying energy ratings and refrigerant types.

- This segment remains the company’s primary revenue generator and accounts for a substantial share of its market dominance.

- Electronics:

- The company produces printed circuit board assemblies (PCBAs) for consumer durables, home appliances, telecom, and other electronics.

- Notably, Amber has ventured into smart wearables, hearables, and telecom equipment, thereby diversifying its revenue streams within the electronics industry.

- Anti-dumping duties imposed on PCB imports have given Amber an opportunity to onboard new clients in the electronics sector, including automotive (EV), aerospace, and defense industries.

- Components:

- Amber manufactures functional RAC components, such as heat exchangers, fans, condensers, motors, and other essential parts.

- It also produces components for consumer durables and automobiles, further enhancing its revenue base by tapping into different verticals.

- Mobility Applications:

- The company provides specialized air conditioning solutions for mobility applications, including HVAC solutions for railways and defense vehicles.

- Products in this category include roof-mounted ACs for coaches, loco drivers’ cab ACs, and other solutions tailored to transportation needs.

- Motors:

- Amber introduced energy-efficient BLDC (Brushless Direct Current) motors designed for various RAC and HVAC products, which have applications in both residential and commercial sectors.

- The company aims to capture demand in domestic and international markets by expanding its motor offerings for air conditioning and ventilation systems.

The variety of segments reflects Amber’s commitment to diversification, reducing dependency on a single product category, and positioning itself as a comprehensive solution provider for multiple industries.

Recent Product Additions and Innovations

In the first quarter of FY25, Amber expanded its product range by introducing:

- Tower ACs

- Window Top Throw Inverter Series

- Tropical high-efficiency split air conditioners

- Cassette air conditioners

- Bare PCBs in the electronics division

These new product launches cater to specific consumer demands and high-efficiency requirements in the Indian market, enabling Amber to maintain its competitive edge. Furthermore, these product additions support the company’s objective of capitalizing on the increasing demand for energy-efficient, high-performance air conditioning solutions.

Financial Performance and Key Metrics

Revenue Contribution (Q1 FY25):

- Consumer Durables: 80%

- Electronics: 16%

- Railway Sub-Systems & Mobility: 4%

Financial Ratios and Highlights:

- Market Cap: ₹20,786 crore

- Current Price: ₹6,154

- Stock P/E: 112

- Book Value: ₹625

- ROCE (Return on Capital Employed): 10.2%

- ROE (Return on Equity): 6.74%

- Dividend Yield: 0%

Amber’s financial metrics reflect a mixed performance, with a high P/E ratio of 112, indicating that the stock is relatively expensive. The company’s ROCE and ROE values, at 10.2% and 6.74% respectively, are modest but align with the industry average. However, the zero dividend yield may be a concern for income-focused investors, as the company reinvests its profits into growth and expansion rather than paying dividends.

Operating Metrics:

- The company has demonstrated a median sales growth of 28.2% over the last 10 years, which is indicative of its strong market position and ability to capture rising demand.

- One downside is the high valuation, with the stock trading at 9.85 times its book value, making it relatively overvalued compared to peers.

Pros and Cons:

- Pros: Consistent sales growth, market leadership in the RAC industry, diverse product offerings.

- Cons: High valuation, low ROE, no dividend payments, and heavy dependency on capital expenditure.

Quarterly and Yearly Trends

A closer look at the financial trends reveals the following patterns:

- Quarterly Trends (Q1 FY25 vs. Q4 FY24):

- Revenue: ₹1,685 crore (slightly lower compared to ₹2,401 crore in Q4 FY24)

- Net Profit: ₹21 crore (down from ₹75 crore in Q4 FY24)

- EPS: 5.7 (down from 21.48 in Q4 FY24)

- Yearly Trends:

- Compounded sales growth for the past 10 years stands at 21%, while the compounded profit growth is 20%, showcasing consistent performance.

- Amber has also shown resilience during challenging periods, achieving a compounded profit growth of 16% over the last three years.

Cash Flow and Debt Levels:

- Amber has managed its cash flow with operating cash flows consistently positive, even though it has increased its borrowing to fund expansions.

- The borrowings surged from ₹1,539 crore in FY23 to ₹2,032 crore in FY24, reflecting the company’s investment in growth and diversification, particularly in new facilities.

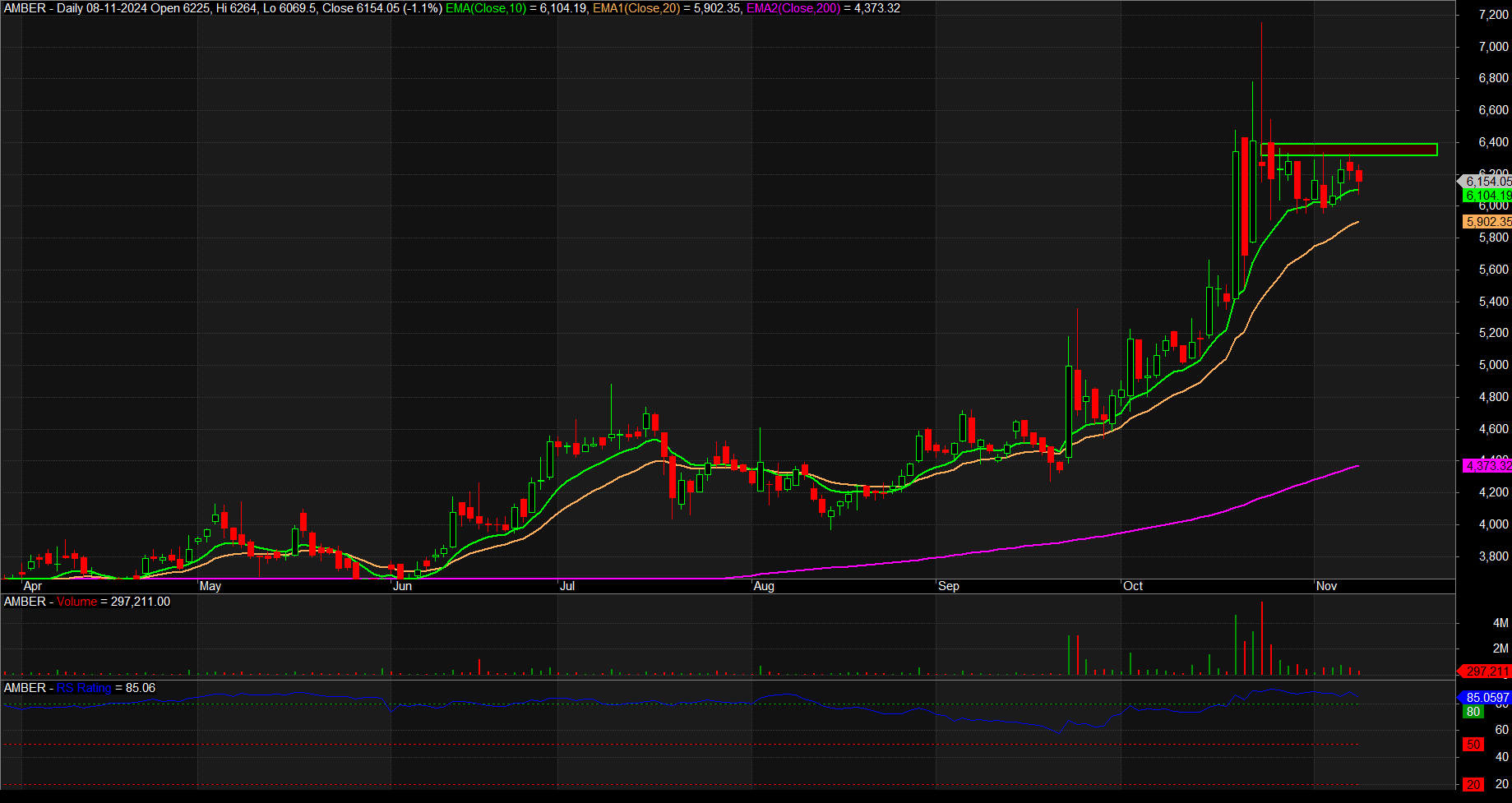

Daily Chart of Amber Enterprises India Ltd. (AMBER)

Technical Analysis

- Price Action: The stock has shown a strong uptrend from June to November, with a clear pattern of higher highs and higher lows. Recently, it encountered some resistance around the 6,400 level, which seems to be a key resistance zone. The current price is consolidating just below this resistance, which may indicate a pause before the next move.

- Moving Averages:

- The 10-day EMA (green line) is above the 20-day EMA (orange line), both of which are sloping upwards, signaling a bullish momentum.

- The 200-day EMA (purple line) is far below the current price, confirming a strong long-term uptrend.

- The price consistently trades above both the 10-day and 20-day EMAs, which act as dynamic support levels.

- Volume: Trading volume appears to have increased during the initial uptrend but has slightly tapered off during recent consolidation. A breakout above 6,400 with higher volume would strengthen the bullish case.

- RS Rating: The stock has a Relative Strength (RS) rating of 85, suggesting that it has been outperforming most other stocks. This indicates strong relative strength, a positive sign for momentum traders.

- Support and Resistance:

- Resistance: Around the 6,400 level, where price has struggled to break above.

- Support: The 5,900 level, near the 20-day EMA, could act as immediate support if the price pulls back.

- Conclusion: Amber Enterprises is in a strong uptrend but is currently in a consolidation phase near resistance at 6,400. A breakout above this level with volume could lead to further upside. However, a failure to break above this resistance may result in a short-term pullback to the 5,900 support area.

This setup looks favorable for bullish traders, especially if the stock breaks above the 6,400 resistance with strong volume.

Expansion Plans and Manufacturing Capabilities

Amber is heavily investing in expanding its manufacturing footprint to capitalize on rising demand:

- Manufacturing Facilities: As of FY24, Amber has 24 facilities for consumer durables and 5 for electronics. It has plans for a new facility in North India, and another greenfield facility for SIDWAL (a subsidiary), expected to be operational by Q1 FY26.

- Capital Expenditure (Capex): In FY23, the company spent ₹698 crore on capex. For FY24-FY25, it has allocated ₹350-375 crore for R&D, subsidiary expansion, and brownfield expansions.

- PLI Scheme: Amber has qualified for the Production-Linked Incentive (PLI) scheme in both normal and large categories, expecting to receive the initial PLI payment in FY24. This scheme provides an additional revenue stream and supports Amber’s expansion plans in high-demand sectors.

Competitive Analysis and Industry Position

Amber operates in a highly competitive market but has managed to establish itself as a top player in the RAC and OEM/ODM space, competing with companies like Kaynes Tech, PG Electroplast, and Genus Power. A few differentiators give Amber a competitive advantage:

- Strong Clientele: With over 20 established OEM clients, Amber enjoys long-standing relationships with industry giants, which provides stability in its revenue streams.

- Technological Edge: Amber’s joint venture with Yujin Machinery Ltd. aims to enhance its technological capabilities, especially for mobility solutions in railways and defense.

- Comprehensive Product Line: With an extensive range of components and fully-assembled units, Amber offers a one-stop solution, which is valuable to clients seeking cost-effective, end-to-end manufacturing solutions.

Read Also : Kotyark Industries Poised for Breakout

Outlook and Future Prospects

Amber is well-positioned to leverage India’s rising demand for air conditioning and consumer durables. With a focus on expanding its product offerings in the electronics and components segments, Amber is aiming to diversify its revenue base and reduce dependence on RACs. The PLI scheme, capex investments, and an emphasis on R&D are likely to drive growth in the coming years.

The company’s strategy to expand into smart electronics and mobility solutions, coupled with its manufacturing expansions, indicates that Amber is preparing for long-term growth. However, challenges remain in the form of high valuations, moderate ROE, and the need to improve profitability ratios. As India’s economy and middle class continue to grow, the demand for consumer durables, especially air conditioning, is expected to increase, providing Amber with a strong market to tap into.

Conclusion

Amber Enterprises India Ltd. has built a formidable presence in the air conditioning and electronics manufacturing sectors in India. With a robust product portfolio, strategic expansions, and a steady client base, the company is set for sustainable growth. However, investors should be cautious of its high valuations and low ROE. Amber’s future growth will depend on its ability to improve margins, leverage new technologies, and expand its footprint in high-growth sectors like electronics and mobility solutions. For long-term investors, Amber presents an attractive opportunity, but with potential risks in terms of valuation and capital expenditure needs.